|

|

|

|

|||||

|

|

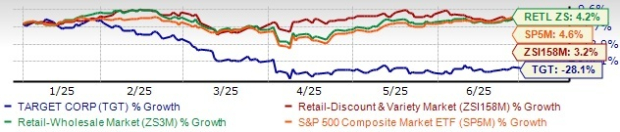

Target Corporation TGT has experienced a significant decline over the past six months, with its shares plummeting 28.1%, underperforming the Zacks Retail - Discount Stores industry's rally of 3.2%. The company also trailed the Retail-Wholesale sector’s growth of 4.2% and the S&P 500's growth of 4.6% during the same period.

TGT’s Past 6 Months’ Performance

The recent decline in the TGT stock’s price is led by the reduced fiscal 2025 guidance amid softer consumer demand, lower spending per visit and declining store traffic. Persistent margin pressures from elevated markdown activity and rising digital fulfillment costs have weighed on profitability, raising concerns about the company’s ability to defend earnings amid a cautious retail environment.

Target has also underperformed its peers, including Dollar General Corporation DG, Dollar Tree, Inc. DLTR and Costco Wholesale Corporation COST.

Shares of Dollar General, Dollar Tree and Costco have rallied 51.2%, 29.5% and 8.8%, respectively, over the same period.

TGT’s Performance vs. Peer Performance

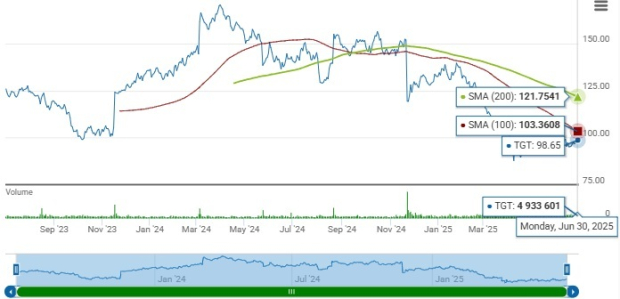

Closing at $98.65 in yesterday’s trading session, the TGT stock stands 41.1% below its 52-week high of $167.40 reached on Aug. 21. Target is trading below its 100 and 200-day simple moving averages of $103.36 and $121.75, respectively, signaling bearish sentiment in maintaining the recent performance levels.

TGT Trades Below 50 & 200-Day Moving Averages

The recent slide in the stock has contributed to Target’s discounted status. This leading general merchandise retailer is currently trading at a compelling discount relative to its industry. The TGT stock trades at a forward 12-month price-to-earnings (P/E) ratio of 12.75, lower than the industry’s average of 32.30.

TGT P/E Ratio (Forward 12 Months)

The current valuation appears compelling when compared with peers. Dollar General, Dollar Tree and Costco are all trading at higher forward P/E ratios of 19.01, 17.34, and 50.57, respectively.

Target’s stock has been under pressure following its disappointing first quarter fiscal 2025 results and a significant cut to its full-year guidance. The company reported adjusted earnings per share (EPS) of $1.30, sharply down from $2.03 in the same quarter last year. Total sales also fell 2.8% year over year to $23.85 billion.

In response to its weaker-than-expected performance, Target revised its full-year outlook. It now projects a low-single-digit decline in sales and has lowered its adjusted EPS guidance to $7.00-$9.00 from the earlier mentioned $8.80-$9.80.

At the core of Target’s challenges is its struggling retail performance, especially in physical stores, which remain the key part of its business model. Comparable sales dropped 3.8% year over year, led by a significant 5.7% decline in comparable store sales. Overall traffic fell 2.4% and average transaction size declined 1.4%.

Margin pressures further dampened investor sentiment. The gross margin fell by 60 basis points to 28.2% due to increased markdown activity and rising costs tied to digital fulfillment and supply-chain operations. Margin pressures were influenced by higher digital sales penetration and costs related to the ramp-up of new supply-chain facilities.

Operational costs also rose sharply. Increased costs related to labor investments, healthcare costs, general liability and startup costs associated with new capital projects pressured Target’s fiscal first quarter adjusted EPS by approximately 50 cents year over year.

Increased investments in wages, healthcare benefits and store openings added about 50 cents of year-over-year pressure on the fiscal first quarter adjusted EPS. Combined with deleveraging effects from lower sales and rising SG&A costs, Target’s profitability has taken a significant hit. Further complicating the challenge are external risks such as tariff uncertainties and macroeconomic pressures.

Reflecting cautious sentiment around Target, the Zacks Consensus Estimate for EPS has seen downward revisions. Over the past 30 days, the consensus estimates for the current and next fiscal years have declined by seven cents to $7.55 and five cents to $8.15 per share, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

TGT is taking several steps to navigate the ongoing challenges in the retail environment. Leveraging its strong brand reputation and broad product assortment, the company continues to expand its e-commerce capabilities and physical store presence.

A major growth driver is Target Plus, its third-party marketplace, which saw a 20% year-over-year increase in Gross Merchandise Value (GMV) in the fiscal first quarter. By adding hundreds of partners and targeting $5 billion in GMV by 2030, Target aims to deepen customer engagement, particularly in key categories like home and apparel.

A significant part of Target’s strategy also focuses on enhancing customer loyalty through its membership program, Target Circle 360. Same-day delivery services tied to this program grew more than 35% in the fiscal first quarter, showcasing how exclusive benefits and faster fulfillment are helping drive customer retention and repeat purchases.

In addition to digital growth, Target remains committed to strengthening its physical store network. The company opened three stores in the fiscal first quarter and plans to add 20 locations by the end of the year. It is also heavily investing in store remodels, which have proven effective in boosting sales. Completed remodels have delivered a 2-4% rise in comparable sales in the first year and close to 3% in the second year, reflecting improved customer shopping experiences and increased store productivity.

On the supply-chain side, Target is proactively mitigating risks associated with tariffs and international trade uncertainties. The company has diversified its sourcing strategy, reducing its dependency on China from 60% in 2017 to under 30% in the fiscal first quarter, with a goal of bringing it below 25% by 2026.

Target is also working closely with vendor partners, adjusting its buying and production strategies, and exploring alternative sourcing locations to cushion the impacts of potential future tariffs.

By combining digital innovation, customer-centric programs, store investments and supply-chain resilience, Target is positioning itself to better weather short-term pressures and drive long-term growth.

Given the magnitude of challenges facing Target, including declining store traffic, pressured margins and a downwardly revised earnings outlook, current and potential investors may want to adopt a cautious stance. While the company is actively pursuing initiatives to stabilize performance, such as digital expansion, loyalty programs and supply-chain diversification, those efforts will take time to materially shift the trajectory.

Until there is clearer evidence of a turnaround, staying on the sidelines or closely monitoring execution progress may be the more prudent course of action. At present, TGT carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

FedEx joins other US companies in seeking a refund after Trump tariffs are ruled illegal

COST

Associated Press Finance

|

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite