|

|

|

|

|||||

|

|

SoundHound AI SOUN has emerged as one of the more dynamic voice AI players in recent months. With a staggering 55% surge in its stock price over the past three months, it has significantly outpaced the broader market. For context, SOUN has outperformed the S&P 500’s 18.2% gain, the Zacks Computer and Technology sector’s 28.2% rise, and even the Zacks Computers - IT Services industry’s 16.6% increase.

Yet despite this momentum, the stock remains nearly 49.1% below its 52-week high of $24.98, though it still trades 222.6% above its 52-week low of $3.94. So, with this rebound, is there still more upside to capture?

SOUN Stock Price Performance

Let’s assess what’s driving SoundHound’s momentum and evaluate its long-term investment potential.

SoundHound reported $29.1 million in revenues in first-quarter 2025, up 151% year over year. Growth was fueled by the successful integration of acquisitions, including Synq3, Amelia, and Allset. These deals expanded SoundHound's reach in restaurants, enterprise AI, and voice commerce.

The company’s core advantage lies in its proprietary Polaris foundation model, which supports multi-modal, multi-lingual voice AI. This technology powers the Amelia 7.0 platform, a next-generation Agentic AI offering that enables autonomous voice-powered agents. Polaris delivers industry-leading performance in latency, accuracy, and noise handling, making SoundHound's solutions particularly compelling in real-world enterprise deployments.

Voice commerce is another emerging pillar. With more than 13,000 restaurant locations already using its AI, and pilots underway with major automotive OEMs, SoundHound is pioneering voice-enabled transactions such as food ordering while driving. The company is also expanding its use cases to include hotel booking, reservations, and parking.

Once viewed primarily as an automotive AI vendor, SoundHound has successfully broadened its customer base. In the first quarter of 2025, it reported strong renewals and expansions across verticals such as healthcare, telecom, financial services, hospitality, and energy. Notable wins included a large British telecom company, a Latin American resort operator, and one of the world's largest insurance companies in Europe.

The Amelia 7.0 platform, launched in the first quarter, enables businesses to deploy AI agents capable of handling complex workflows and transactional tasks. This positions SoundHound as a differentiated player in the rapidly growing Agentic AI landscape. With AI adoption still ramping across industries, SoundHound's domain-specific voice AI strategy gives it a competitive edge.

Operationally, SoundHound is gaining traction. Active cloud users rose by more than 50% in the first quarter, and the company experienced a tenfold rise in restaurant activations year over year. Its AI platforms are now handling more than 2 billion voice queries per quarter, up significantly from prior levels. Bookings also grew at a double-digit rate year over year, reflecting strong pipeline conversion.

Within restaurants, SoundHound is rapidly expanding its footprint among quick-service chains such as Five Guys, Habit Burger, and White Castle. The company’s Smart Answering and Smart Ordering tools are replacing legacy phone systems with AI-driven solutions that enhance customer experience and drive upsells.

The enterprise segment, meanwhile, is benefiting from cross-sell synergies tied to the Amelia acquisition. Deployments in financial services, healthcare, and IT support are reinforcing SoundHound’s value proposition as a full-stack AI solution provider.

While the growth narrative is strong, valuation is a key concern. SoundHound trades at a forward 12-month Price-to-Sales (P/S) ratio of 27.19X, significantly higher than the industry average of 19.56X. Historically, its three-year P/S range spans from 2.92X to 94.40X, highlighting the stock’s volatility and sensitivity to investor sentiment.

SOUN Stock Valuation

High-growth AI stocks often trade at premium multiples, but SoundHound's path to profitability will need to materialize to sustain such a valuation. Any slowdown in growth or delay in margin improvement could expose the stock to downside risk, especially in a macro environment sensitive to earnings quality.

Despite operational progress, SoundHound remains unprofitable on a non-GAAP basis. It posted a non-GAAP net loss of $22.3 million in the first quarter and an adjusted EBITDA loss of $22.2 million. GAAP net income of $129.9 million was largely the result of a non-cash gain from changes in fair value of acquisition-related liabilities.

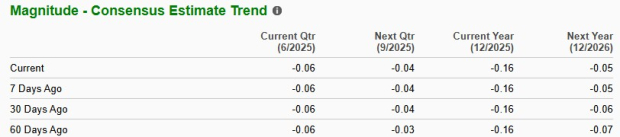

The Zacks Consensus Estimate for SoundHound’s 2025 EPS has remained unchanged over the past 60 days at a loss of $0.16 per share. While the estimate stability is encouraging in the context of a fast-evolving AI market, a meaningful upward revision could act as a stronger catalyst for the stock.

Management continues to guide for full-year 2025 revenues of $157 million to $177 million. It also reaffirmed its commitment to achieving adjusted EBITDA profitability by the end of 2025. While the top-line outlook remains robust, investors should closely watch for margin improvements and cost discipline across R&D and S&M spend.

SoundHound continues to face stiff competition from tech giants Alphabet GOOGL, Amazon AMZN, and Apple AAPL, all of whom dominate the voice AI space. Google Assistant leads in Android Automotive, Amazon’s Alexa benefits from AWS and a vast developer base, and Apple’s Siri is deeply embedded across iPhones and CarPlay. These rivals enjoy strong brand loyalty and ecosystem lock-in, making customer acquisition tough for SoundHound.

To compete, SoundHound must focus on niche, embeddable voice solutions that offer more flexibility than Big Tech. However, challenges persist. Automotive demand softened due to global supply chain issues, and gross margins remain under pressure from legacy contracts and acquisition-related costs. While SoundHound expects automotive voice commerce adoption to grow, Apple, Amazon, and Alphabet are aggressively expanding in this space, adding to the near-term competitive strain.

SoundHound’s recent rally reflects growing confidence in its scalable AI platform, successful vertical expansion, and early leadership in voice commerce and Agentic AI. The company’s technology, customer traction, and balance sheet strength ($246 million in cash, no debt) support a long-term bullish case.

However, elevated valuation and continued operating losses introduce risks. With the 2025 EPS estimate unchanged and profitability still targeted for late 2025, much of the upside appears priced in for now.

Given its Zacks Rank #3 (Hold), SoundHound stock is best suited for patient investors already holding a position. Near-term upside may be limited unless we see accelerated margin expansion or upward earnings revisions. For new investors, it may be prudent to wait for more clarity on execution and financial improvement before initiating fresh positions. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 36 min | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite