|

|

|

|

|||||

|

|

Celsius Holdings, Inc. CELH is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 45.27X, representing a significant premium compared with the Zacks Food - Miscellaneous industry average of 15.96X, the broader Consumer Staples sector of 17.32X, and the S&P 500 of 22.61X. The current valuation also exceeds the median P/E level of 33.07 recorded over the past year. Such a high multiple raises a key question: Does CELH offer enough growth to justify this premium, or has the stock entered overvalued territory?

This premium valuation becomes even more striking when stacked against other major beverage players such as PepsiCo, Inc. PEP, Monster Beverage Corporation MNST, and The Coca-Cola Company KO. PepsiCo, Monster Beverage, and Coca-Cola are all trading at lower forward P/E ratios of 16.76X, 30.26X and 22.43X, respectively.

Beyond valuation, recent stock performance further highlights Celsius Holdings' strong momentum. Over the past three months, CELH shares have rallied 24%, significantly outperforming the industry, sector and S&P 500’s growth of 0.1%, 1.1%, and 19%, respectively. Among competitors, Monster Beverage stock gained 3%, while PepsiCo and Coca-Cola stocks lost 2.2% and 2.4%, respectively, in the same time frame. This impressive rally reflects bullish sentiment around CELH's growth trajectory but also contributes to the current valuation premium.

Celsius Holdings continues to strengthen its position in the energy beverage market, driven by the core Celsius brand and the acquisition of Alani Nu, finalized on April 1, 2025. Together, Celsius Holdings and Alani Nu accounted for approximately 20% of the total dollar growth in the energy drink category during the first quarter of 2025. With complementary brand identities and strong consumer traction, the combined portfolio enhances Celsius Holdings’ ability to capture a broader customer base and foster long-term brand loyalty.

A focus on sugar-free, better-for-you products remains central to the company’s strategy. As consumers increasingly seek healthier, ingredient-conscious beverages, Celsius Holdings is well-positioned to capitalize on this shift. Notably, sugar-free energy drinks contributed 86% of the total growth in the energy category during the first quarter, underscoring the relevance of CELH’s product lineup.

Innovation continues to fuel expansion. In the first quarter of 2025, the company introduced new Vibe and ESSENTIALS flavors, alongside the launch of CELSIUS HYDRATION, a product designed to tap into the growing $1.4 billion hydration powder market. These launches are driving deeper household penetration, supporting CELH’s evolution from an occasional purchase to an everyday staple.

Retail expansion also remains a key growth lever. The company has recently expanded its distribution through more than 1,800 Home Depot locations and 18,000 Subway restaurants, thereby increasing its presence in both foodservice and on-the-go consumption channels. This enhanced retail footprint sets the stage for continued growth across multiple sales platforms.

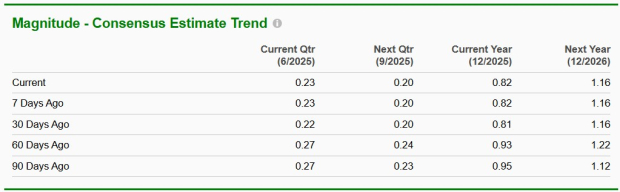

Reflecting positive sentiment around Celsius Holdings, the Zacks Consensus Estimate for earnings per share has seen upward revisions. Over the past 30 days, the consensus estimate has risen 1 cent each for the current quarter and the current financial year to 23 cents and 82 cents, respectively. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

While growth prospects remain robust, Celsius Holdings faces several near-term challenges that could pressure the stock. The energy drink market remains highly competitive, with established players like Monster Beverage and Red Bull maintaining an edge in shelf space, brand loyalty, and marketing scale. Both competitors continue to expand their product offerings and pursue aggressive pricing strategies. In this environment, Celsius Holdings must work harder to defend and grow market share, especially as the category evolves rapidly.

In the first quarter of 2025, Celsius Holdings reported a 7% year-over-year revenue decline, primarily due to lower product velocity, changes in promotional timing, and difficult comparisons against the prior year’s CELSIUS ESSENTIALS nationwide rollout. The revenue dip marks a slowdown in momentum compared to the company’s strong historical performance.

Rising operating expenses add another layer of risk. Selling, general, and administrative costs increased to $120.3 million in the first quarter from $99 million a year earlier, reflecting increased marketing, sales expansion, and costs related to the Alani Nu acquisition. Although these investments aim to fuel long-term expansion, they could pressure margins if revenue growth does not recover at the expected pace.

Celsius Holdings has achieved remarkable stock performance, driven by aggressive expansion, innovative product development, and the strategic acquisition of Alani Nu. The company’s emphasis on sugar-free, functional beverages aligns with shifting consumer preferences, and an expanding retail footprint supports continued category growth. That said, the current valuation remains elevated compared to industry peers, raising questions about near-term upside.

Recent revenue declines, higher operating expenses, and intensifying competition from brands like Monster and Red Bull add further challenges. Given these factors, long-term investors may consider holding the stock. Currently, CELH carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 6 hours | |

| 9 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite