|

|

|

|

|||||

|

|

Seven months into 2025, and President Donald Trump’s ‘Liberation Day’ is the story of the year on Wall Street thus far. On April 2nd, Trump signed an executive order imposing ‘reciprocal tariffs’ on America’s trading partners, with a minimum 10% tariff on all US imports. Although Donald Trump had talked about how the United States has been getting ripped off on trade for more than three decades, Wall Street investors were caught off guard by the magnitude and aggressiveness of Trump’s tariff plan. The rest is history: panic ensued, with the Nasdaq 100 dumping more than 5% in a single session. Within a week, the major US indices would fall into bear market territory, with tariff-sensitive stocks like Apple (AAPL), Nike (NKE), Nvidia (NVDA), and Advanced Micro Devices (AMD) getting slammed the hardest.

While the tariff correction was painful due to its speed, Wall Street bulls’ fortunes would turn for the better on April 9th when President Trump announced a 90-day pause on tariffs and proclaimed, “THIS IS A GREAT TIME TO BUY!” The Nasdaq 100 Index (QQQ) would jump a mind-boggling 12% in a single session, leading to a relentless grind to fresh all-time highs. The 90-day pause signaled to investors that Trump was using the excessive tariffs as leverage for more optimal trade deals. Fast-forward to today, and the US has signed preliminary trade deals with the UK, Japan, Vietnam, Indonesia, China, and the European Union (EU). Below are five misconceptions the bears had that were wrong, including:

1. Myth: “Trading Rivals Will Not Come to the Negotiation Table”:

Reality: The US has massive trade deficits with numerous countries across the world. Because the US is the largest consumer of goods worldwide, rival countries selling goods to the US had more to lose in a trade war, providing President Trump and his negotiating team with leverage. Meanwhile, US Secretary of Commerce Howard Lutnick has come up with ingenious deal frameworks for countries like Japan that are unwilling to open their markets. Japan will ‘buy’ its way into the US market (a 15% tariff instead of 25%) with a massive $550 billion investment into the United States (of which the US will keep 90% of the profits).

2. Myth: “Trump Tariffs will lead to rampant inflation for Americans.”

Reality: While inflation could rear its ugly head in the future, the US ‘Truflation’ number is at a tepid 2.01% - lower than when Trump was elected.

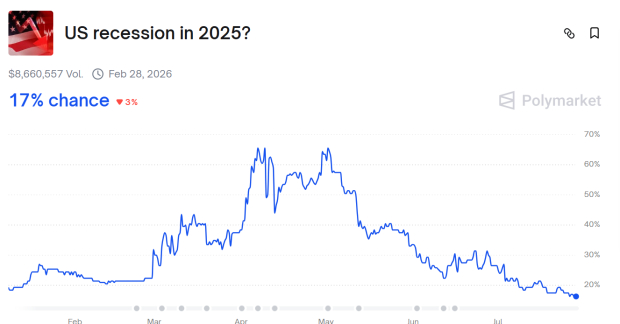

3. Myth: “Tariffs will cause a recession in 2025.”

Reality: While the odds of a 2025 recession were once as high as 66% on the Polymarket betting website, they have since slid to just 17% as tariff fears have subsided. Additionally, the Federal Reserve Bank of Atlanta’s GDPNow model forecasts a 3.1% growth rate.

4. Myth: “Foreign companies will not ‘eat’ tariffs.”

Reality: Thus far, Trump’s tariffs are working as intended. Honda (HMC) and Toyota (TM) have relocated much of their production to the United States to circumvent tariffs. Meanwhile, numerous foreign automakers have been forced to lower export prices to avoid being priced out of the vast US market.

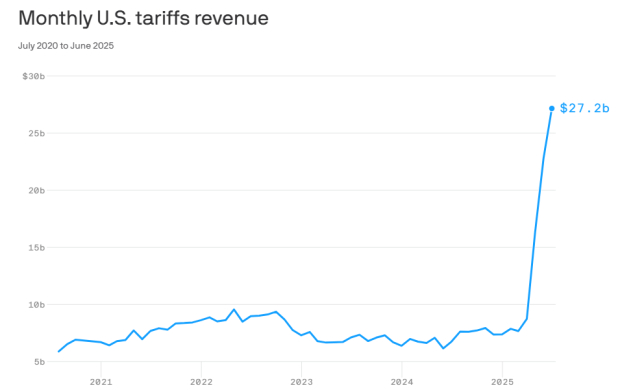

5. Myth: “Tariff revenue will be insignificant.”

Reality: The US government is now generating roughly $20 billion per month in tariff revenue, and Treasury Secretary Scott Bessent says that $300 billion per year is possible.

Bottom Line

Words talk, data screams. Thus far, Trump’s Tariffs have defied the skeptics and the talking heads. There is no recession on the horizon, inflation is in check, and tariff revenue is soaring.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 min |

Stock Market Today: Dow, Tech Futures Slide; Nvidia Extends Losses (Live Coverage)

NVDA

Investor's Business Daily

|

| 14 min |

AI Stocks Reset In 2026 Amid Software Reckoning, Hyperscaler Capex Boom

NVDA

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

Apple To Hold Product Event On March 4. Cheaper iPhone Seen But No AI Siri

AAPL

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite