|

|

|

|

|||||

|

|

PPL Corporation’s PPL shares have risen 1.3% since its second-quarter 2025 earnings release on July 31. Earnings of 32 cents per share missed the Zacks Consensus Estimate of 37 cents by 13.5%. In the year-ago quarter, the company reported earnings of 38 cents per share.

PPL stock closed at $36.15 on Aug. 6. In the past month, the company’s shares have gained 7.7% compared with the industry’s 5.2% rally. PPL has also outperformed the S&P 500’s growth of 1.6% and the Zacks Utility sector’s increase of 4.5% during the said period.

Is it a good time to add this electric power stock to your portfolio? Let's examine the key factors that contributed to the share price gain, review its second-quarter results and assess the investment prospects.

Total revenues of $2.03 billion surpassed the Zacks Consensus Estimate of $1.98 billion by 2.15%. The top line also increased 7.7% from the year-ago figure of $1.88 billion.

The bottom line came down year over year, primarily due to the timing of certain true-ups and higher operating costs, unfavorable weather conditions as compared with the second quarter of 2024 and higher interest expense.

PPL is focused on reducing other operations and maintenance expenses, and it was able to do so by 1.4% in the reported quarter.

PPL’s Kentucky Regulated segment reported adjusted earnings per share (EPS) of 18 cents, which remained flat year over year. This was due to lower sales volumes, largely due to weather, offset by other factors. PPL's Pennsylvania Regulated segment consists of the regulated electricity delivery operations of PPL Electric Utilities. Its earnings from ongoing operations in the second quarter decreased 2 cents per share compared with the year-ago level. Factors driving earnings results primarily included higher operating costs, the timing of a transmission revenue true-up and other factors, partially offset by higher transmission revenue from additional capital investments.

In the second quarter, the company sold 15,737 gigawatt hours of electricity to its customers in Pennsylvania and Kentucky, reflecting a 0.9% year-over-year decline.

The company’s interest expenses amounted to $199 million, up 9.3% from $182 million in the corresponding period of 2024.

PPL beat on earnings in two of the trailing four quarters and missed in two, delivering a negative surprise of 0.18%.

Another company from the same industry, Exelon Corporation EXC, reported second-quarter earnings on July 31. It delivered quarterly earnings of 39 cents per share, which beat the Zacks Consensus Estimate of 37 cents by 5.4%. Exelon beat on earnings in each of the trailing four quarters, delivering an average surprise of 7.02%.

PPL continues to benefit from its focus on infrastructure construction projects for generation, transmission and distribution. Customers have been experiencing far less outages, courtesy of the company’s initiative to further strengthen its infrastructure.

PPL is experiencing growth in load, driven by increasing demand from data centers. Nearly 14.4 gigawatts (GW) (up from 11 GW) of potential data center demand are in the advanced stages, representing a potential transmission capital investment of $0.75-$1.25 billion (up from $700-$850 million). Active data center requests have increased to 50 GW for the 2026-2034 period in the Pennsylvania segment.

In the Kentucky segment, the Economic development queue holds total potential load growth of 8.5 GW, which includes active data center requests of 6 GW from 2026-2032 and 3 GW of manufacturing and other non-data center load. Powerhouse data center’s capacity increased from 400 megawatt (MW) to 525 MW.

To meet the rising demand and enhance service quality, PPL plans to invest $20 billion from 2025 through 2028. The capital investment for 2025 and 2026 is expected to be $4.3 billion and $5.2 billion, respectively. This should further strengthen the reliability and resiliency of the electricity grid.

The company’s cost-reduction efforts play a pivotal role in strengthening its financial performance by directly enhancing profit margins. Importantly, these efficiency gains are achieved without compromising the reliability or safety of PPL’s electricity delivery, allowing it to maintain customer satisfaction while improving its bottom line. PPL targets to reduce its other operating and maintenance costs by at least $150 million by 2025 and $175 million by 2026.

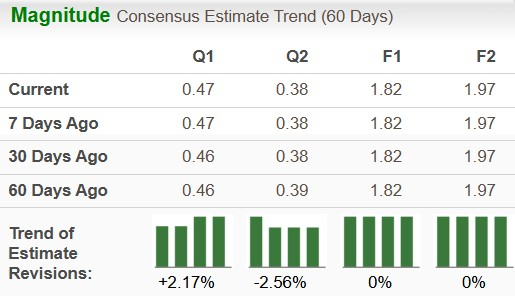

The Zacks Consensus Estimate for 2025 and 2026 earnings per share has remained unchanged in the past 60 days.

Another company, Xcel Energy XEL, is also set to gain from competitive advantages and a robust pipeline to capture data center demand. Xcel Energy expects a total customer request for data centers of nearly 8.9 GW by 2029. The Zacks Consensus Estimate for Xcel Energy’s 2025 and 2026 EPS has also remained unchanged in the past 60 days.

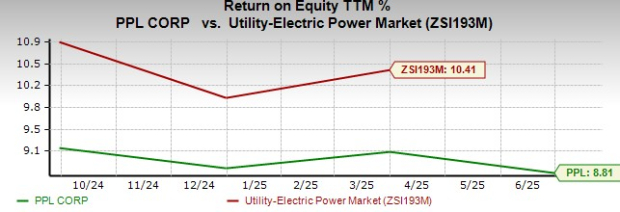

PPL has a trailing 12-month return on equity of 8.81% compared with the industry average of 10.41%. Return on equity, a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

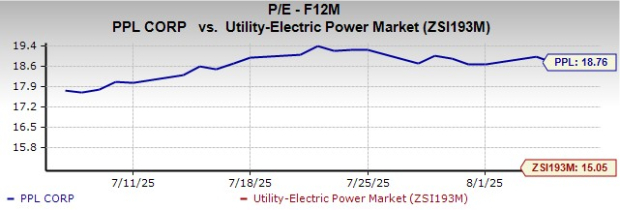

PPL is currently trading at a premium compared with its industry on a forward 12-month P/E basis.

Exelon and Xcel Energy are also trading at a premium compared to the industry on a forward 12-month P/E basis.

PPL has a long history of dividend payments and plans to increase its annual dividend in the range of 6-8% through at least 2028, subject to the approval of its board of directors. Currently, its quarterly dividend is 27.25 cents per share, resulting in an annualized dividend of $1.09 per share.

It expects the dividend payout ratio to be in the range of 60-65%. The strong cash flow generation capacity enables the company to pay a consistent dividend to shareholders. Check PPL’s dividend history here.

PPL’s strategic investments help it improve infrastructure and boost service reliability. Increasing demand from data centers will have a positive impact on its top line. The company is also expected to benefit from its cost reduction initiatives that help strengthen its financial performance by directly enhancing profit margins.

However, PPL’s lower ROE compared to its industry average, weakness in share price and premium valuation are concerning. Investors may hold onto this Zacks Rank #3 (Hold) stock at the moment and enjoy the benefits of regular dividends. Given its premium valuation, new investors can wait and look for a better entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 8 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite