|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The Coca-Cola Company KO has witnessed significant year-to-date growth, pushing the stock above industry thresholds and portraying bullishness from a technical standpoint. Coca-Cola’s stock is benefiting from a blend of resilient demand, strategic pricing and investor recognition of its defensive strengths.

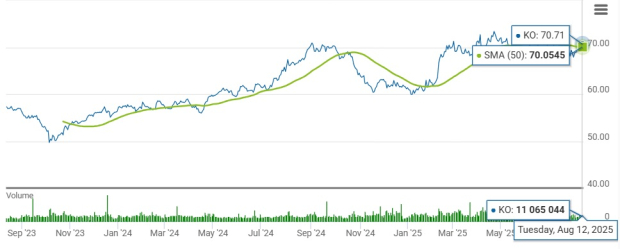

Backed by the momentum, the KO stock recently surpassed its 50-day simple moving average (SMA). On Aug. 8, 2025, the stock closed at $70.34, crossing the 50-day SMA of $70.08. Since then, the KO stock has been on an uptrend.

Coca-Cola’s move above its 50-day moving average signals a shift in short-term momentum, suggesting that buying interest is strengthening after a period of consolidation or weakness. Technically, this level often acts as a key trend indicator, and breaking above it can attract additional investor attention, particularly from traders who view it as a bullish signal. It may also indicate improving sentiment toward KO’s fundamentals and market outlook.

The 50-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as it is the first marker of an uptrend or a downtrend. SMA is an essential tool in technical analysis that helps investors evaluate price trends by smoothing out short-term fluctuations.

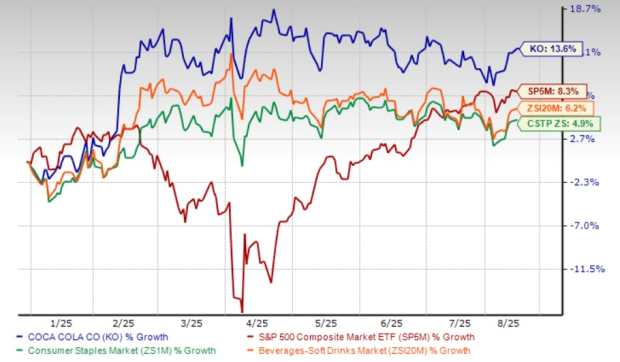

Coca-Cola’s momentum in the year-to-date period is evident from its 13.6% rally, which led it to outpace the Zacks Beverages – Soft Drinks industry and the broader Consumer Staples sector’s advances of 6.2% and 4.9%, respectively. The stock also marked an outperformance relative to the S&P 500’s growth of 8.3% in the same period.

KO’s performance is notably stronger than that of its key competitor, PepsiCo Inc. PEP, which declined 3.4% year to date. The stock also outpaced Keurig Dr Pepper Inc.’s KDP growth of 8.4% and Monster Beverage Corporation’s MNST growth of 21.8% in the same period.

At its closing price of $70.71 yesterday, the KO stock trades 4.9% below its 52-week high mark of $74.38 and 16.6% above its 52-week low of $60.62.

Coca-Cola’s recent momentum is rooted in strong business fundamentals, resilient demand and strategic execution. In second-quarter 2025, the company delivered solid organic revenue growth, driven by pricing initiatives, product innovation and balanced volume performance across key markets.

Premium offerings and category expansion in areas like ready-to-drink beverages and protein-based shakes have helped broaden its portfolio appeal, while targeted marketing has reinforced brand strength globally. The asset-light franchise model continues to enhance operational efficiency and protect margins, even amid cost pressures.

A key driver has been Coca-Cola’s pricing power, enabling it to offset inflationary impacts without significantly eroding demand. Growth in emerging markets, coupled with stable performance in developed regions, reflects the company’s ability to adapt to local consumer trends while maintaining consistent brand positioning. Additionally, digital initiatives and partnerships with bottling partners have improved supply-chain agility, supporting on-time delivery and inventory management.

However, risks remain. Currency volatility, shifting consumer preferences, and increased competition in both traditional soda and non-carbonated categories may pressure growth. Macroeconomic uncertainty and potential regulatory actions on sugar-sweetened beverages also present ongoing challenges. Moreover, while pricing has been a key growth lever, over-reliance could strain volumes if economic conditions weaken.

Overall, Coca-Cola’s momentum reflects a blend of global brand equity, diversified offerings and disciplined execution. While the growth story remains intact, investors should watch for how the company balances pricing, innovation and market expansion against a backdrop of evolving consumer behaviors and economic headwinds.

The Zacks Consensus Estimate for Coca-Cola’s 2025 EPS was unchanged in the last 30 days. Meanwhile, the consensus estimate for 2026 EPS has moved up by a penny in the past 30 days.

For 2025, the Zacks Consensus Estimate for KO’s revenues and EPS implies 3.2% and 3.1% year-over-year growth, respectively. The consensus mark for 2026 revenues and earnings suggests 5.6% and 8.4% year-over-year growth, respectively.

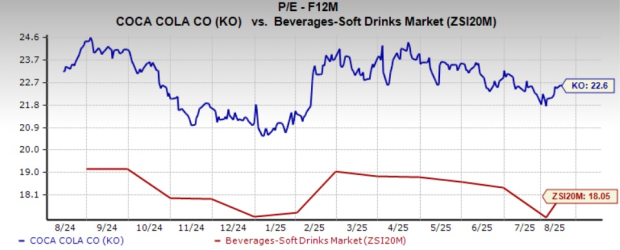

KO’s current forward 12-month price-to-earnings (P/E) multiple of 22.6X raises concerns about whether the stock's valuation is justified. This multiple is significantly higher than the Zacks Beverages – Soft Drinks industry average of 18.05X, making the stock appear relatively expensive.

At 22.6X P/E, Coca-Cola trades at a significant premium to most of its industry peers. The company’s peers, such as PepsiCo and Keurig Dr Pepper, are delivering solid growth and trade at more reasonable multiples, while Monster Beverage trades at a premium multiple. PepsiCo and Keurig Dr Pepper have forward 12-month P/E ratios of 17.76X and 16.35X, significantly lower than KO. However, Monster Beverage trades at a P/E multiple of 32.04X.

The KO stock’s premium valuation suggests that investors have strong expectations for its growth. However, the stock currently seems somewhat overvalued. Coca-Cola’s ability to meet or exceed these lofty expectations is crucial in justifying its premium pricing.

Coca-Cola’s move above its 50-day SMA reinforces the stock’s strong technical momentum, reflecting sustained investor confidence supported by steady demand, pricing power and a globally recognized brand. Positive estimate revisions for 2026 earnings further highlight market optimism about the company’s ability to deliver growth. This combination of technical strength and encouraging forecasts positions KO as a resilient player in the consumer staples space.

However, the premium valuation leaves little margin for error, and ongoing challenges, including currency volatility, shifting consumer preferences and regulatory risks, may affect future gains. While the bullish momentum is notable, Coca-Cola must maintain consistent execution to justify investor expectations and sustain its upward trajectory. Existing shareholders may consider holding their positions, while new investors may wait for more attractive entry points before initiating exposure in this Zacks Rank #3 (Hold) company. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite