|

|

|

|

|||||

|

|

Shares of Royal Caribbean Cruises Ltd. RCL have rallied 38.4% in the past three months compared with the Zacks Leisure and Recreation Services industry’s 15.2% rise. Over the same timeframe, the stock has outperformed the S&P 500’s growth of 9.9%.

Royal Caribbean’s recent stock surge has been fueled by stronger-than-expected close-in demand and strong contributions from its TUI Cruises joint venture. Despite lingering concerns about post-COVID value erosion, booking trends remain strong well into 2025 and 2026, underscoring the resilience of cruise demand.

Investor confidence has been further lifted by Royal Caribbean’s robust pipeline of growth initiatives, including a steady rollout of new ships, expansion into high-margin private destinations, and entry into river cruising supported by digital and AI-driven enhancements. These catalysts are expected to accelerate progress toward the company’s 2027 Perfecta financial targets while unlocking meaningful upside in 2028 with additional vessels and destinations coming online. Positioned to capture a larger share of the $2 trillion global vacation market, Royal Caribbean appears well-placed to drive sustained growth and long-term shareholder value.

The key question for investors now is whether to climb aboard RCL’s rally or wait for smoother waters. Let’s break down what’s fueling the stock’s momentum and if there’s still room to ride the wave higher.

Royal Caribbean’s growth momentum remains firmly anchored in resilient demand for cruise vacations, highlighted by record load factors of 110% in the second quarter of 2025 and strong booking volumes extending into 2026. Consumers continue to show a willingness to pay for premium experiences, supporting higher yields and reinforcing the cruise sector’s position as an attractive alternative to land-based vacations. This demand strength has enabled the company to raise full-year earnings per share (EPS) guidance (by 31% year over year), underscoring confidence in its ability to sustain revenue growth.

Fleet expansion is serving as a powerful catalyst. The addition of Star of the Seas and Celebrity Xcel in 2025, along with a pipeline of Icon, Oasis, and Edge-class vessels, is expected to capture strong consumer interest and drive pricing power. These ships feature innovative designs and enhanced guest amenities that elevate the overall vacation experience, while increased deployment in high-demand regions such as the Caribbean and Europe positions the company to attract new cruisers and deepen engagement with repeat guests.

Operational discipline has also strengthened profitability. In the second quarter, net yields rose more than 5% year over year, while onboard spending reached record levels, supported by higher advance purchases of beverage packages, dining, and excursions. This combination of cost efficiency and stronger-than-expected revenue performance has translated into improved margins, cash flow growth and greater financial flexibility.

Royal Caribbean’s investment strategy continues to focus on differentiated experiences and brand-building initiatives. Projects such as the Royal Beach Club in Nassau and Perfect Day Mexico are designed to expand high-margin destination offerings, while digital innovations and loyalty programs are driving greater pre-cruise engagement and repeat bookings. Coupled with investment-grade ratings, reinstated dividends, and planned share repurchases, these initiatives reinforce the company’s ability to deliver sustainable, long-term shareholder value.

In 2025, the company expects adjusted EPS to be between $15.41 and $15.55 compared with the previous expectation of $14.55-$15.55.

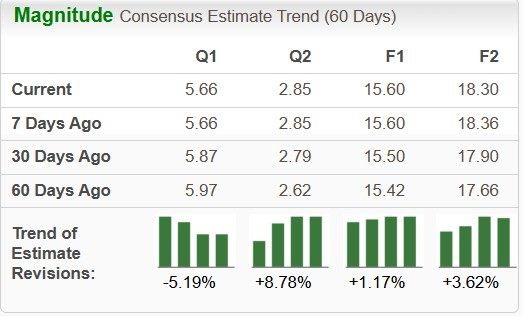

The Zacks Consensus Estimate for RCL’s 2025 EPS has increased 1.2% in the past 60 days. This upward trend reflects strengthened analyst confidence in the stock’s near-term prospects.

Over the same time frame, earnings estimates for industry players, including Carnival Corporation & plc CCL, Norwegian Cruise Line Holdings Ltd. NCLH, and OneSpaWorld Holdings Limited OSW, have increased 6.4%, 0.5% and 2%, respectively.

Royal Caribbean continues to face mounting cost pressures that threaten to erode profitability and weigh on future earnings growth. In the second quarter of 2025, net cruise costs excluding fuel rose by 2.1% year over year. While this came in below earlier guidance due to the timing shift of certain expenses into the second half, the deferral only delays — not eliminates — the financial burden. Management confirmed that approximately 230 basis points of cost growth in the third quarter will stem from Star of the Seas delivery timing and deferred expenses from the second quarter.

Looking ahead, net cruise costs excluding fuel are projected to increase by 6% to 6.5% in the third quarter, with additional inflationary pressures expected from ramping up new private destinations like Royal Beach Club Paradise Island and the recent acquisition of the Costa Maya port. The company anticipates a full-year fuel expense of $1.14 billion, adding to the cost headwinds.

Management acknowledged that the cruise industry remains exposed to external factors such as geopolitical tensions, which can disrupt itineraries and temporarily affect booking momentum.

On the financial side, Royal Caribbean emphasized progress in strengthening its balance sheet, highlighting that the company has regained investment-grade ratings from all three major agencies. At the same time, management reiterated that reducing the sizable debt accumulated during the pandemic remains a priority, even as the company continues to invest in its fleet and destination projects.

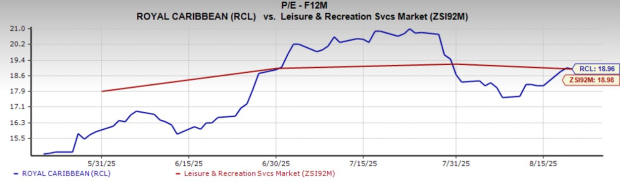

Royal Caribbean stock is currently trading at a discount. RCL is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 18.96X, below the industry average of 18.98X, reflecting an attractive investment opportunity. Other industry players, such as Carnival, Norwegian Cruise and OneSpaWorld, have P/E ratios of 13.30X, 10.29X and 19.69X, respectively.

From a technical perspective, RCL is currently trading above its 50-day moving average, indicating solid upward momentum and price stability.

Royal Caribbean’s 2025 story is defined by resilient demand, upgraded earnings guidance, and a strong pipeline of new ships and destinations. Record onboard spending and stronger yields continue to validate the strength of Royal Caribbean’s brand and pricing power, while investment-grade ratings and resumed shareholder returns highlight its solid financial footing. However, rising operating costs, fuel expenses, and lingering macroeconomic risks temper the near-term outlook.

For now, Investors are advised to monitor how effectively the management navigates rising cost pressures in the second half of 2025 and whether upcoming fleet additions deliver sustainable margin expansion. Until Royal Caribbean shows clearer progress in balancing its growth ambitions with disciplined cost control, RCL stock remains better suited as a hold rather than an aggressive buy.

Royal Caribbean currently has a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite