|

|

|

|

|||||

|

|

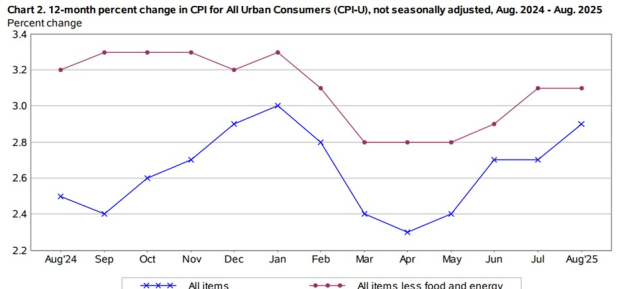

The S&P 500 and Nasdaq etched out another day of fresh highs, as inflation data from August came in line with most economists' expectations. Although headline CPI was elevated from July’s readings, hopes of the Federal Reserve cutting interest rates are still intact, with the market anticipating a 25 basis point rate cut, as opposed to a steeper half a percentage point cut.

The consumer price index (CPI) rose 2.9% year over year in August compared to 2.7% in July. Month over month, CPI increased 0.4% compared to July’s 0.2% uptick. That said, core CPI, which excludes volatile food and energy prices and is the Fed’s preferred inflation reading, remained unchanged, reflecting the same 0.3% and 3.1% monthly and annual increase as July.

Diving deeper into the CPI summary, here is the breakdown of the main movers of individual item indexes from the U.S. Bureau of Labor Statistics, and a strategic opinion of what stocks could stand to benefit or be affected.

Shelter costs were up +0.4% in August, the biggest contributor to the CPI’s monthly rise. The monthly index for rent increased +0.3%. The lodging away from home index rose +2.3% over the month.

Description & Stocks to Watch: Holding the largest weight in the breakdown of the CPI sub indexes (30-35%), the reading for shelter costs is reason to believe homebuilder stocks that have rebounded sharply amid rate cut hopes may become more attractive. After all, this could bring more buyers to the market if rent prices keep going up. Plus, mortgage rates have drifted to their lowest levels in the last year, and homebuilders that cater to a more affluent customer base have been less affected by inflation implementations, such as Toll Brothers TOL. That said, Housing Starts (new homes) data will give a clearer picture next Wednesday, September 17.

Regarding the increase in lodging away from home, hotel operators are making up for the cost of higher labor, food, and beverage expenses. Marriott MAR is a notable leader that has seen its stock dip this year, but there could still be better buying opportunities ahead, especially if the spike in lodging dulls travel demand.

Overall monthly food costs were up +0.5%, and +2.7% annually. Food at home was up +0.6% monthly and +2.7% annually. Food away from home was up +0.3% monthly and +3.9% annually.

Description & Stocks to Watch: The spike in food and grocery costs may be evidence of the implications tariffs have on supply chains. Consumers have no choice but to pay up for essential items, so some food and grocery retailers may be able to mirror the cost increase and benefit, while a frugal shift in consumer shopping behavior has benefited a price-efficient omnichannel retailer like Walmart WMT for quite some time now.

Enjoying food away from home, on the other hand, is discretionary, and consumers have shunned dining out at premium retail-restaurants with Chipotle CMG being a prime example, as its stock is near 52-week lows of around $38 a share.

Monthly Energy tracking increased +0.7% overall, and was up +2.2% YoY. Led by a +1.9% monthly increase in gasoline prices, although this was down 6.6% YoY.

Description & Stocks to Watch: The general seasonal increase from summer demand was a factor here, as geopolitical tensions haven’t caused a surge in crude oil prices, which are just over $60 a barrel. Sanctions that may take Russian oil off the market again will be something to keep an eye on, and of course, oil conglomerates like Exxon Mobil XOM and Chevron CVX can capitalize on higher energy prices.

Used cars & trucks prices were up +1.0% monthly, and +6.0% annually. The index for airline fares increased +5.9% month over the month, and +3.3% annually.

Description & Stocks to Watch: Part of the broader all-items less food and energy CPI tracker, the results here may be dampening to transportation and auto related industries, as higher prices can reduce travel demand and spending on big-ticket items like cars.

Still, long-term opportunities can arise to invest in some of the major automakers and airliners that should be able to overcome inflation and tariff impacts, with General Motors GM and Delta Air Lines DAL coming to mind. In its latest SEC filing, Delta lifted its revenue guidance for Q3 on Thursday. And with used car prices being the headline and rising more sharply than new car prices, this could persuade consumers to upgrade, benefiting GM and other automakers.

Apparel costs were up +0.5% monthly and 0.2% annually, showing signs of tariff-driven inflation.

Description & Stocks to Watch: Also part of the all items less food and energy tracking, this is not a favorable reading for apparel retailers, as consumer spending could decline, especially for premium clothing or accessories. However, companies with a competitive advantage through brand recognition and pricing power may benefit, with Ralph Lauren RL having a bit of both.

Notably, Ralph Lauren’s Zacks Textile-Apparel Industry is currently in the bottom 22% of over 240 Zacks industries, but its stock has been a standout while other popular peers such as Crocs CROX have struggled. Ralph Lauren stock is up +35% YTD and recently hit a 52-week peak of $321.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 5 hours | |

| 7 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours | |

| 13 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite