|

|

|

|

|||||

|

|

Oracle’s cloud investments are paying off big time.

Oracle has set clear five-year expectations.

If it delivers, it’s reasonable to assume the stock could more than double from here.

Oracle (NYSE: ORCL) surged a mind-numbing 36% on Wednesday to close the session at a market cap of $922 billion. Five years ago, Oracle's market cap was under $200 billion. Now, there's reason to believe it can surpass $2 trillion by 2030.

If that prediction comes true, Oracle could be well on its way to joining Nvidia (NASDAQ: NVDA), Microsoft (NASDAQ: MSFT), Apple, Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), Amazon (NASDAQ: AMZN), Broadcom (NASDAQ: AVGO), and Meta Platforms in the $2 trillion club. Broadcom and Meta Platforms are currently under $2 trillion but would surpass the threshold with gains of 16% or less.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

The "Ten Titans" -- which are these companies plus Tesla and Netflix -- now make up a staggering 39% of the S&P 500 (SNPINDEX: ^GSPC) and have proven to be a formidable group of market-moving stocks.

Here's why Oracle deserves to be in the conversation of market-leading growth stocks and why the company could more than double from here in less than five years.

Image source: Getty Images.

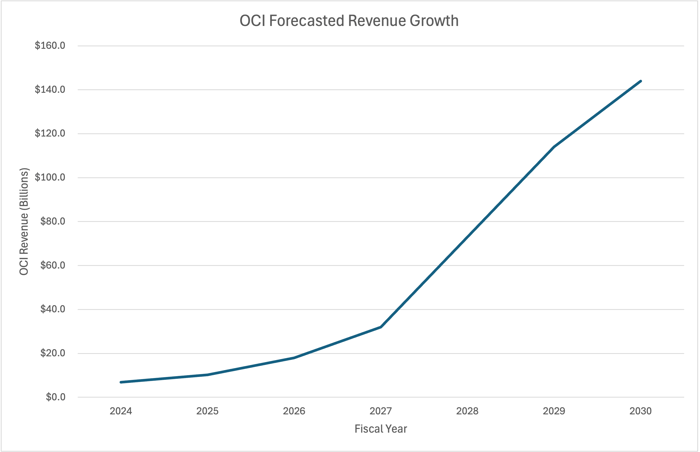

In its first quarter fiscal 2026 earnings release from Sept. 9, Oracle projected Oracle Cloud Infrastructure (OCI) revenue to grow from $18 billion in its current fiscal year to $144 billion by fiscal 2030. Oracle also provided revenue guidance by fiscal year for the next four years.

Data source: Oracle. Chart by author.

To understand the gravity of Oracle's projections, consider that, in 2024, Google Cloud generated $33.1 billion in revenue, Microsoft's entire Intelligent Cloud segment notched $105.4 billion in revenue, and Amazon Web Services, the largest cloud computing provider in the world by market share, generated $108 billion in revenue.

Of course, Google, Microsoft, and Amazon are all projecting solid cloud growth. But Oracle's forecast suggests that OCI, in terms of cloud infrastructure revenue, will be bigger than the current size of AWS in less than four years, which is probably the single most aggressive prediction any tech company has made this year.

As you can see in the graph, OCI is projected to reach an inflection point in fiscal 2027 as data centers come online to fulfill Oracle's massive order backlog. In its latest earnings release, Oracle announced plans to deliver an additional 37 multi-cloud data centers to its three major hyperscaler partners -- Amazon, Microsoft, and Alphabet -- to bring its total to 71. In June, Oracle said that it had 23 multi-cloud data centers with 47 more being built in the next 12 months -- meaning it added 10 in the latest quarter. But these are just its multi-cloud data centers. Oracle is also building standalone data centers designed strictly for running OCI services, such as AI workloads and its Exadata Database service, which is optimized using specific infrastructure.

Oracle is in an enviable position because it offers customers competitively priced bundles that combine cloud services with other offerings, and because it is expanding its business through partnerships with multiple cloud providers. A big part of this pricing advantage comes from the way Oracle's data centers are built. According to Oracle, "OCI bare metal instances, not available from other cloud providers, coupled with microsecond-latency RDMA [Remote Direct Memory Access] cluster networking provide 50% better price-performance and 3.5X time savings for HPC [high performance computing] workloads compared with previous-generation compute." RDMA is an Oracle network fabric that reduces latency.

In sum, Oracle's data centers are brand-new and hyper-efficient, allowing it to achieve better performance and offer attractive pricing to gain market share. In some ways, Oracle is like the Broadcom of the data center world. Broadcom is winning a lot of business from hyperscalers thanks to its XPU custom AI chips, which are advanced application-specific integrated circuits (ASICs) that can be an effective alternative to graphics processing units in some (but not all) applications. Just as Broadcom is essentially working with Nvidia in the data center, so too is Oracle working with the established cloud giants -- forming a partly competitive, partly symbiotic relationship. It's a peculiar dynamic, but one where Oracle and Broadcom have a compelling advantage.

If Oracle comes close to its fiscal 2030 OCI revenue target, it wouldn't be surprising to see the stock at least double from here. Based on Amazon's market cap of $2.46 trillion, you could argue that AWS is worth about $1.5 trillion on its own. With that logic, OCI alone could be worth $2 trillion if it eclipses AWS's current size in five years. So it's not unreasonable to expect Oracle to surpass $2 trillion in market cap by 2030 -- again if it delivers on expectations. And that's a big if.

Oracle is spending heavily to build out its infrastructure, so it's best not to look too deeply into its earnings. However, once its infrastructure is more established, Oracle could pull back on spending, which will boost its margins and allow the company to transition back to high-margin free cash flow.

Oracle stock is worth buying and holding if you believe its disruption of the cloud computing industry is built to last. But the stock's valuation is heavily dependent on its ability to fulfill and profit from its order backlog. So some investors may prefer to take a wait-and-see approach to the Ten Titans stock right now.

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Daniel Foelber has positions in Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 14 min | |

| 17 min | |

| 35 min |

Asian shares are mixed after Nvidia's losses pull Wall St lower, as AI-linked layoffs rattle markets

NVDA

Associated Press Finance

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite