|

|

|

|

|||||

|

|

Carnival Corporation & plc CCL and Royal Caribbean Cruises Ltd. RCL — two leaders of the global cruise industry — are charting strong courses in 2025, fueled by resilient demand, premium vacation trends and strategic investments in destination-led growth. Both operators are capitalizing on consumers’ growing appetite for experience-driven travel, yet their approaches to expansion and value creation differ markedly.

For investors seeking exposure to the next leg of the cruise recovery, the question is: Which stock offers the more compelling buy right now?

Carnival’s transformation continues to gain traction, supported by its destination-led growth model and a disciplined focus on yields, cost efficiency and balance sheet repair. The company’s exclusive Caribbean portfolio — including Celebration Key, Half Moon Cay and Mahogany Bay — has become a core differentiator, providing immersive experiences that rival land-based resorts.

The recent debut of Celebration Key, already drawing strong guest satisfaction and premium pricing, underscores Carnival’s ability to monetize unique assets. With millions of annual visitors expected and multiple pier expansions planned, the destination will likely serve as a key revenue driver for years to come.

Carnival is also modernizing its fleet to align with evolving consumer preferences. Programs like AIDA Evolutions are upgrading ships with new wellness, dining and entertainment concepts, while upcoming Excel-class and Princess-class ships add higher-margin capacity and appeal to family and premium travelers alike.

Financially, Carnival is entering a new phase of strength. The company’s ongoing deleveraging and refinancing efforts have significantly improved its balance sheet, paving the way for a potential return to investment-grade credit and eventual capital returns to shareholders. With over half of next year’s bookings already locked in at higher prices, the company’s pricing power and demand visibility remain robust.

Royal Caribbean is advancing its long-term “Perfecta” strategy — a blueprint centered on sustained earnings growth, disciplined expansion and innovation-led guest experiences. The company continues to balance premium product leadership with operational efficiency, driving both strong demand and pricing power across its portfolio of world-class brands.

With the recent addition of Star of the Seas and the upcoming launch of Celebrity Xcel, Royal Caribbean is advancing its fleet with next-generation designs, sustainable technology and enhanced guest amenities. These ships are engineered to drive higher onboard revenues, broaden demographic appeal and reinforce the company’s reputation for innovation.

On the destination front, Royal Caribbean’s pipeline remains robust. Projects such as Royal Beach Club Paradise Island and Perfect Day Mexico are expected to elevate the guest experience and strengthen pricing across key itineraries. These exclusive, high-margin destinations play a critical role in sustaining yield growth and expanding the company’s competitive moat.

The company is also making meaningful strides in digital transformation and loyalty integration. Nearly half of onboard purchases are made through its mobile app, improving convenience and pre-cruise monetization. Meanwhile, loyalty members account for roughly 40% of bookings and spend significantly more per trip, supporting durable revenue growth and higher guest retention over time.

However, Royal Caribbean faces some near-term profitability challenges. Elevated operating expenses, higher fuel and food costs and ramp-up costs from newly launched ships are expected to pressure margins in the coming quarters. Additionally, the timing of certain destination investments could modestly impact free cash flow in the short term.

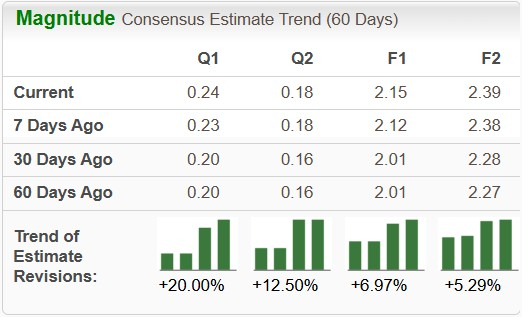

The Zacks Consensus Estimate for Carnival’s fiscal 2025 sales and EPS suggests year-over-year increases of 6.5% and 51.4%, respectively. In the past 60 days, earnings estimates for fiscal 2025 have risen 7%.

The Zacks Consensus Estimate for Royal Caribbean’s 2025 sales and EPS suggests year-over-year increases of 9.1% and 32.5%, respectively. In the past 60 days, earnings estimates for 2025 have increased 0.3%.

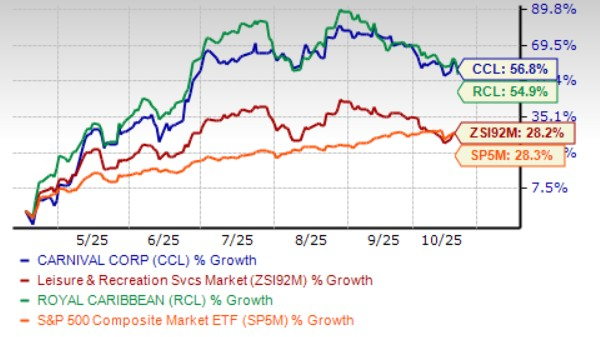

Carnival stock has rallied 56.8% in the past six months, significantly outpacing its industry and the S&P 500’s rise of 28.2% and 28.3%, respectively. Meanwhile, Royal Caribbean shares have gained 54.9% in the same time.

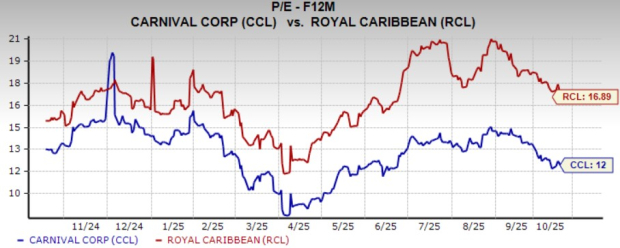

Carnival is trading at a forward 12-month price-to-earnings (P/E) ratio of 12X, below the industry average of 17.48X over the last year. RCL’s forward 12-month P/E multiple sits at 16.89X over the same time frame.

Both Carnival and Royal Caribbean are navigating 2025 from positions of strength, supported by record bookings, resilient consumer demand and strong pricing momentum. Each company is executing a clearly defined strategy — Carnival through its destination-led, value-focused transformation, and Royal Caribbean through its premium, innovation-driven growth model.

However, from an investment standpoint, Carnival currently offers the more compelling setup. Its improving leverage profile, accelerating yield growth and expanding Caribbean destination network position it for sustained margin expansion and a potential return to capital distributions. The company’s execution on fleet renewal and balance sheet repair also suggests further upside as it edges closer to investment-grade credit.

Royal Caribbean remains a long-term standout in the premium travel segment, but near-term cost pressures and a richer valuation may temper upside in the quarters ahead.

Given its stronger estimate revisions, attractive valuation and growing financial flexibility, Carnival earns the edge as the better near-term buy.

Carnival currently sports a Zacks Rank #1 (Strong Buy), while Royal Caribbean has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite