|

|

|

|

|||||

|

|

The Trade Desk (TTD) stock has tumbled 15.6% in the past month and closed last session at $43.26, way below its 52-week high of $141.53 and closer to its 52-week low of $41.77. The stock has lost 5.8% since reporting third-quarter 2025 earnings on Nov. 6, 2025.

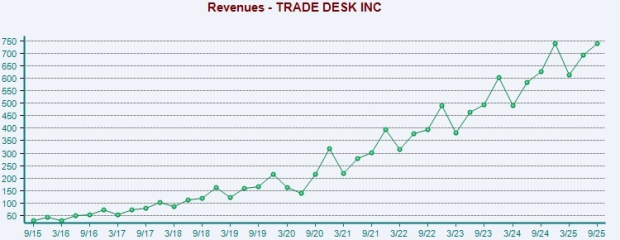

Revenues increased 18% year over year to $739 million and beat the consensus mark by 3%. This came above the company’s revenue expectation of at least $717 million. Connected TV or CTV once again emerged as the fastest-growing channel.

On the profitability front, adjusted EBITDA came in at $371 million compared with $257 million in the year-ago quarter. Adjusted EPS was 45 cents, topping estimates and increasing from 41 cents in the year-ago quarter, with free cash flow at $155 million.

So, what is causing the slide for TTD stock? Let us take a closer look at TTD’s fundamentals, growth drivers, competitive advantages and potential risks, and assess whether it is wise to stay invested

The Trade Desk has multiple tailwinds that could buoy its long-term growth. These include CTV, retail media, Kokai, UID2 and OpenPath.

One of the most compelling long-term opportunities for The Trade Desk is CTV, the fastest-growing segment of the digital ad market. On the last earnings call, management noted that the transition toward biddable CTV is gaining rapid momentum and it expects decision CTV to become the default buying model in the future. The benefits of decision-based buying (like greater flexibility, control and performance) compared with traditional programmatic guaranteed or insertion-order models, are rendering it the logical choice for advertisers.

Further, Kokai, the company’s AI-powered platform, which is used by 85% clients as their default experience, is strengthening its competitive moat. TTD highlighted that Kokai delivered (on average) 26% better cost per acquisition, 58% better cost per unique reach and a 94% better click-through rate compared with Solimar. Embedding AI to enhance Kokai bodes well.

TTD’s OpenPath and OpenAds initiatives further strengthen its ecosystem by connecting advertisers directly to publishers, improving transparency and supply-chain efficiency.

The Trade Desk’s strategy revolves around the open Internet, which is where price discovery and competition exist. Management noted that average consumers spend about two-thirds of their online time on the open Internet, but advertisers allocate far less than that proportion of their budgets.

The Trade Desk price-consensus-eps-surprise-chart | The Trade Desk Quote

Management estimates that about 60% of its total addressable market lies outside the United States. International business currently represents roughly 13% of total revenues, a clear opportunity for long-term growth.

TTD boasts a strong balance sheet with a cash position (cash, cash equivalents and short-term investments) of $1.4 billion at the end of the third quarter, with no debt. As digital advertising shifts toward AI-driven, outcome-based campaigns, The Trade Desk’s cash strength offers a buffer against macro volatility. In a market increasingly defined by capital discipline and platform efficiency, The Trade Desk’s liquidity and free cash flow generation may prove to be one of its most durable advantages.

The company repurchased $310 million worth of stock in the third quarter and approved a new buyback plan of $500 million.

For the fourth quarter of 2025, the company anticipates revenues of at least $840 million.

As a pure-play ad tech stock, macro volatility is immensely concerning for The Trade Desk. If macro headwinds worsen, revenue growth may face pressure due to reduced programmatic demand.

While The Trade Desk remains a leading independent DSP, the competitive environment is intensifying. Walled gardens like Meta Platforms, Apple, Google and Amazon (AMZN) dominate this space as they control their inventory and first-party user data, allowing for highly targeted ad campaigns. While CTV remains a strong revenue driver, this market is also increasingly becoming competitive. AMZN’s expanding DSP business is giving tough competition to TTD, especially in this space.

Even smaller players like Magnite (MGNI) and PubMatic (PUBM) are expanding their presence in CTV and retail media and competing for ad dollars.

Though TTD is focusing on geographic expansion, executing well across disparate markets can be complex and risky. Regulatory and privacy-related changes like the deprecation of cookies and tightening data-privacy laws like Europe’s GDPR also pose ongoing challenges.

Higher expenses are likely to weigh on profitability. In the last reported quarter, total operating costs (excluding stock-based compensation) surged 17% year over year to $457 million. Expenses soared on account of continued investments in boosting platform capabilities, particularly platform operations. TTD is focused on embedding AI across the portfolio, which will further raise capex and operational costs. Rising expenses coupled with investments could compress margins if revenue growth slows.

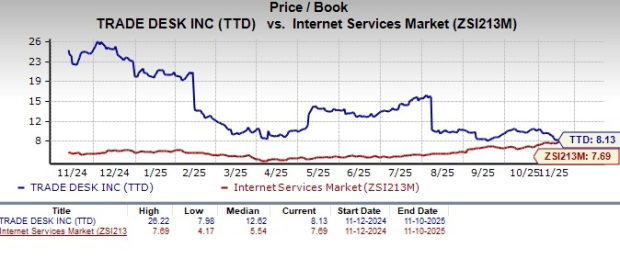

TTD stock is not so cheap, as its Value Style Score of D suggests a stretched valuation at this moment. The stock is trading at a premium, with a price/book multiple of 8.13X compared with the industry’s 7.69X.

Amazon has gained 12.9%, while Magnite and PubMatic’s shares have declined 16.8% and 6.7%, respectively, over the past month.

Given the mix of solid fundamentals and near-term headwinds, investors holding TTD stock can retain it in their portfolios for now, but new investors would be better off waiting for a favorable entry point.

At present, TTD carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 37 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours |

Walmart To Report Results, Fresh Off New Highs, A New CEO And $1 Trillion Market Cap

AMZN

Investor's Business Daily

|

| 6 hours | |

| 6 hours | |

| 6 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite