|

|

|

|

|||||

|

|

Familiar names like IonQ, Rigetti, and D-Wave have certainly caught the attention of aggressive, risk-tolerant investors.

None of these “pure plays” on quantum computing, however, has the amount of funding and reach as one other name in the business.

Although this company’s twofold opportunity is enormous, it’s also a very long-term opportunity.

Investors following the advent of quantum computing have certainly heard of names like IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), and D-Wave Quantum (NYSE: QBTS). Each of these companies has its own approach to best serving this nascent business. And each of them is promising in their own way.

If you're looking for the best way of capitalizing on the quantum computing opportunity, however, none of these popular but risky prospects is your best bet. The ultimate quantum computing stock is arguably hiding in plain sight. That's Google's parent, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

But first things first.

Here's a quick primer on quantum computing. As impressive as most modern personal computers are compared to the industry's earliest models introduced in the 1970s, their underlying digital architecture remains the same. That's an intricate collection of ones and zeros; you know it as binary code. (Even modern-day artificial intelligence platforms are ultimately built on binary code.)

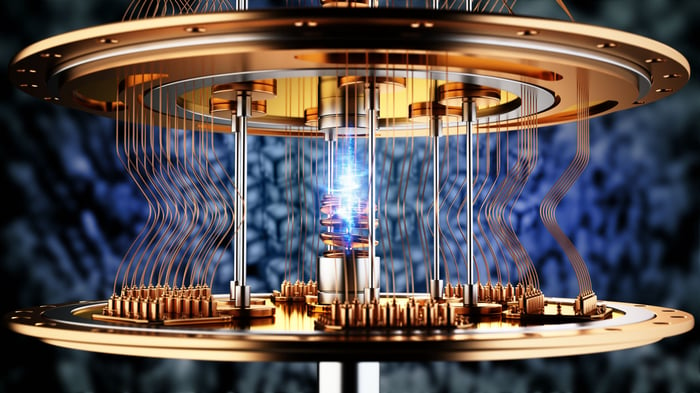

Image source: Getty Images.

Limited to nothing but ones and zeros, though, traditional computing is finally bottlenecked. Computing hardware and software could do so much more with a less encumbered way of handling digital information.

Quantum computing is that way. Using the unique properties of subatomic particles -- referred to within the industry as "qubits" -- a quantum computing processor can simultaneously work with a practically infinite number of numerical values. The end result? Calculations that would take even the best AI data centers weeks, if not months or even years, to complete can be processed by quantum computers in a matter of minutes.

This tech, of course, has enormous potential for areas like drug discovery, cybersecurity, financial modeling, business optimization, and machine learning, just to name a few.

The chief challenge? Capturing and using a single quantum particle as the basis for any type of computing work is neither cheap nor easy. That's why it took decades to turn the idea into a functional technology.

It did eventually happen, with IonQ technically blazing that trail, although, for the record, IBM (NYSE: IBM) did the same thing around the same time. IBM's first quantum platform was more of an experiment, though, and a precursor to its then-record-breaking 1,121-qubit system unveiled earlier this year (more qubits means more computing power). For comparison, IonQ's most powerful platform commercially available right now is its 36-qubit Forte, although it's working on a 64-qubit option. Rigetti's systems are sized more like IonQ's, which makes them less powerful than IBM's but also more affordable. D-Wave, conversely, is building quantum platforms with even more qubits than IBM's.

Even as rivals battle over qubit counts and pricing, Alphabet isn’t playing that game. It's simply building a quantum computer that is practical, reliable, and affordable to use. Late last year, the company officially introduced its quantum processing chip, called Willow. Initially, it had a modest 105 qubits, but it also had an outstanding reduction in the computational errors that are still an issue for quantum computing.

In other words, Alphabet offers quality over quantity to a market that will probably be more interested in the former rather than the latter.

A more marketable solution is only part of the reason Alphabet stock is a smart quantum computing investment, however. There are three other elements to the bullish argument.

First, unlike the smaller pure plays in this space, Alphabet has the financial wherewithal to properly see the development of its quantum platform all the way through to its full commercialization. Last year, for perspective, Alphabet booked a net profit of just over $100 billion. That's more than the market caps of IonQ, Rigetti, and D-Wave combined, and they're all still operating in the red.

This isn't to suggest the industry's smaller players haven't built worthy quantum solutions. It just means they're at least a little operationally constrained, crimping their overall potential upside.

Second, Alphabet already has an existing cloud computing business that can be readily expanded with a quantum computing offering. While the business model for monetizing Alphabet's quantum chips hasn't yet been discussed, if it resembles the initial shape of the quantum computing industry, the company will rent cloud access to this tech. It should be a relatively easy business to start, too, since Alphabet already does about $60 billion in annualized corporate cloud business.

And third, although it's been the least considered aspect of the company's work on quantum computing, Alphabet has much to gain from access to its own quantum computers. This technology could be used to make Google's search engine a personalized way of browsing the internet, for instance. It could also, of course, be used to better train Google's chat-based artificial intelligence app Gemini. Indeed, the possibilities for integrating quantum solutions into any of Alphabet's highly digitized businesses are almost limitless.

The tricky part here is time. As developed as quantum computers already are, meaningful commercialization of this tech is still at least a few years off. Much can change in the meantime.

Nevertheless, Alphabet is still arguably better-equipped to handle any such changes than most -- if not all -- of the other players in this budding industry.

More to the point for interested investors, Alphabet enjoys an unfair advantage over most of the other names in the business, positioning it to win more than its fair share of the quantum market that Boston Consulting Group believes could be worth as much as $170 billion per year by 2040. And that's just for quantum hardware and software providers. BCG expects quantum computing platform users themselves (including Alphabet) to leverage this technology to produce up to $850 billion in annual revenue for the same time frame. That's an enormous potential for growth.

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 10, 2025

James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, International Business Machines, and IonQ. The Motley Fool has a disclosure policy.

| 25 min | |

| 46 min | |

| 2 hours |

Phonographs, Player Pianos and Betamax: The Inventions That Transformed Entertainment

IBM

The Wall Street Journal

|

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 11 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite