|

|

|

|

|||||

|

|

Form 13F filings allow investors to track which stocks Wall Street leading money managers and financial firms are buying and selling.

Collectively, institutional investors were big-time buyers of quantum computing pure-play stocks in the September-ended quarter.

However, multiple historical headwinds are mounting for this hyped technology and the pure-play stocks benefiting from it.

For the better part of the last three years, artificial intelligence (AI) has been the driving trend on Wall Street. Empowering software and systems with the tools to make split-second decisions without the need for human intervention is a multitrillion-dollar opportunity that can positively alter the global growth arc for businesses.

But AI isn't the only innovation moving markets. In fact, a strong argument can be made that AI hasn't even been the hottest trend on Wall Street in 2025. Quantum computing stocks IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT) have respectively rallied by 69%, 1,720%, 1,300%, and 299% over the trailing year, as of the closing bell on Nov. 18.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Early investors in the quantum computing revolution have potentially made life-altering profits -- and Wall Street professionals have taken notice.

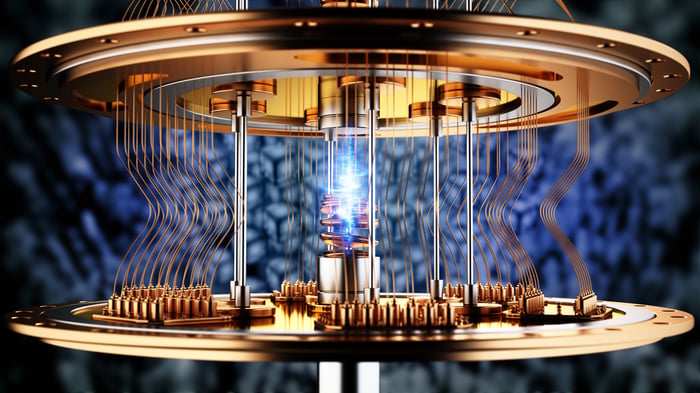

Image source: Getty Images.

Friday, Nov. 14, marked the deadline for institutional investors with at least $100 million in assets under management to file Form 13F with the Securities and Exchange Commission. This required quarterly filing details the stocks that fund managers purchased and sold in the most recent quarter (in this case, the third quarter).

Collectively, 13F filers were avid buyers of quantum computing pure-play stocks during the September-ended quarter. However, this may come back to haunt institutional investors.

According to 13F aggregating website WhaleWisdom.com, net purchasing activity in pure-play quantum computing stocks was pronounced during the third quarter (as of Sept. 30):

The caveat to the above data is that institutional buying isn't always equal. Passive funds purchase or sell stock to mirror the underlying indexes that their products track. Meanwhile, market makers aren't directional traders and will hedge their common-stock positions to be neutral. While some of this activity from passive funds and market makers is included in the above figures, there's clear evidence of institutional investors buying into quantum computing pure-play stocks and expecting upside.

The lure of these stocks lies in the game-changing applications that quantum computing can bring to the table. Specialized computers, which rely on the theories of quantum mechanics, can perform rapid, simultaneous calculations and potentially solve complex problems that classical computers are incapable of tackling. Use case examples include speeding up the learning process of AI algorithms and improving the success rate of clinical drug trials by running molecular interaction simulations.

Investors are likely also encouraged by select "Magnificent Seven" companies incorporating quantum computers into their cloud infrastructure service platforms. For instance, Amazon and Microsoft are both allowing subscribers of their respective quantum-cloud computing services access to IonQ's and Rigetti's specialized computers.

There's eye-popping growth potential with quantum computing, too. All four of the aforementioned pure-play stocks can deliver triple-digit sales growth in 2026. Looking ahead, Boston Consulting Group foresees quantum computing creating up to $850 billion in global economic value by 2040.

Image source: Getty Images.

Although it's not hard to understand why investors are amped about this technology, a confluence of headwinds suggests that recent institutional buyers may be disappointed.

To preface the following discussion, history can't guarantee what's going to happen in the future. It does, however, have a remarkable track record when it comes to foreshadowing what comes next with next-big-thing technologies and game-changing innovations.

Since (and including) the advent and mainstream proliferation of the internet three decades ago, every hyped trend and innovation has eventually (keyword!) worked its way through a bubble-bursting event. Though it's impossible to predict when bubbles will form and burst, historical precedent makes clear that investors consistently overestimate the uptake, utility, and optimization of new technologies and innovations early in their expansion.

Quantum computing is a relatively new technology at the moment. While there are examples of IonQ's, Rigetti's, and D-Wave Quantum's specialized technology being used at the moment, these are rare instances of quantum computers and solutions being commercialized. This technology will require many years to mature, leaving these stocks vulnerable to a bubble-bursting event.

Keeping with the theme of historical precedent, quantum computing stocks are incredibly pricey.

In the quarters leading up to the bursting of the dot-com bubble, some of the most important internet-based businesses reached peaked price-to-sales (P/S) ratios in the neighborhood of 30 to 40. This arbitrary range has served as a sort of ceiling for detecting bubbles over the last three decades.

Based on sales estimates for the upcoming year (2026), here are the projected P/S ratios for Wall Street's quantum computing darlings:

Even if we looked two or three years into the future, projected sales wouldn't come close to lifting these four stocks out of historical bubble territory.

The cherry on top for IonQ, Rigetti, D-Wave, and Quantum Computing Inc. is that Wall Street's Magnificent Seven are loaded with cash, and they generally gravitate to high-growth opportunities. For instance, Microsoft and Alphabet have already developed quantum computing chips. This suggests the early stage advantage quantum computing pure-play stocks have built may prove short-lived.

Despite their near-parabolic gains in 2025, IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. stocks could all plummet in the quarters and years to come.

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $593,222!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,143,342!*

Now, it’s worth noting Stock Advisor’s total average return is 1,013% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 17, 2025

Sean Williams has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, IonQ, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Quantum Computing Stocks: Infleqtion Pops In First Day As Public Company

QBTS -6.25% RGTI IONQ

Investor's Business Daily

|

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite