|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

JPMorgan JPM stock trades at a premium to the industry and its peers. The stock is currently trading at a price-to-tangible book (P/TB) of 3.09X, above the industry average of 2.97X. Further, the Value Score of F suggests that the stock is not so cheap and indicates a stretched valuation at this moment.

Also, JPMorgan (the largest U.S. bank) is expensive compared with two of its closest peers – Bank of America BAC and Citigroup C. At present, Bank of America has a P/TB of 1.93X, while Citigroup is trading at a P/TB of 1.11X.

JPM’s P/TB

JPMorgan shares have not performed well of late. Quarter to date, it has lost 2.5% and also lagged Bank of America and Citigroup, which are up 2.7% and 0.9%, respectively. The stock has underperformed the broader markets.

QTD Price Performance

JPM’s not-so-favorable valuation and bearish investor sentiment might compel you to stay away from the stock. But before making any decision, let’s take a closer look at the company’s fundamentals and growth prospects to understand whether the higher valuation is justified and the current price point supports a buying opportunity.

Diversified, Resilient Business Model: JPMorgan is not just a simple retail lender. It operates across multiple segments, including consumer banking, commercial banking, investment banking, wealth & asset management, etc. That means it has multiple revenue streams and is better positioned to ride out economic cycles rather than being overly dependent on one part of the banking business. When lending slows, or rate-sensitive income softens, divisions such as trading, payments and wealth management often offset the weakness.

JPMorgan also benefits from one of the industry’s largest and most stable deposit bases, giving it low-cost funding and a competitive margin advantage. As of Sept. 30, 2025, the loans-to-deposit ratio was 56%. Its scale, technology investments and global infrastructure create structural efficiencies that smaller banks cannot replicate.

Additionally, a rising share of fee-based income (almost 45% of total net revenues on average) from wealth management and payments enhances stability and reduces reliance on interest-rate dynamics. Even during the pandemic period, the company posted low-to-mid-single-digit revenue growth, when other banks were struggling to maintain top-line growth.

JPMorgan is expanding its branch network in new markets to strengthen its competitive edge in relationship banking, despite the digital shift. In 2024, JPMorgan opened nearly 150 branches and plans to add 500 more by 2027 to deepen relationships and boost cross-selling across mortgages, loans, investments and credit cards. Even Bank of America is growing its 3,664-center network, with 40 new openings last year and 110 more by 2027.

Strong Profitability and Execution Track Record: JPMorgan consistently delivers industry-leading returns through disciplined risk management, prudent balance-sheet strategy and a focus on high-quality lending. Even during volatile rate cycles, it has maintained robust net interest income (NII) by effectively managing deposit costs and optimizing its loan portfolio. In 2020, during the near-zero interest rate backdrop, the company’s NII recorded a 5% decline compared with 11% for Bank of America and 8% for Citigroup.

Currently, as the Federal Reserve has started lowering rates, JPMorgan’s NII is expected to report some pressure, but balance sheet growth and mix are likely to partly offset this. The company expects NII (excluding Markets) to be nearly $92.2 billion in 2025 and $95 billion in 2026. Similarly, Bank of America and Citigroup’s NII are expected to be under pressure over the medium term, though both expect continued NII expansion this year. Bank of America projects NII to rise 6-7% in 2025, while Citigroup expects NII (excluding Markets) to grow 5.5%.

JPMorgan’s non-interest income streams, spanning trading, investment banking (IB), payments and wealth management, provide additional earnings stability and help cushion downturns in any one segment. The bank’s leadership position in the IB business (rank #1 for global IB fees), healthy pipelines and an active M&A market will ensure stronger IB fee growth going forward. Also, JPMorgan, the industry’s leading trading desk, stands to gain from increased client hedging and speculative activity.

Moreover, leadership under Jamie Dimon has emphasized conservatism, capital strength and swift response to market shifts, enabling JPM to outperform competitors through crises, including the global financial downturn and the 2023 regional banking crisis. Even the company came to the rescue of the failed First Republic Bank and acquired it. The buyout supported the company in scaling its wealth management business.

This consistent execution underpins JPMorgan’s ability to sustain superior profitability across cycles.

Fortress Balance Sheet and Solid Liquidity: As of Sept. 30, 2025, JPM had a total debt of $496.6 billion (the majority of this is long-term in nature). The company's cash and due from banks and deposits with banks were $303.4 billion on the same date. The company maintains long-term issuer ratings of A-/AA-/A1 from Standard and Poor’s, Fitch Ratings and Moody’s Investors Service, respectively.

Hence, JPMorgan continues to reward shareholders handsomely. It cleared this year’s stress test impressively and announced an increase in its quarterly dividend by 7% to $1.50 per share, as well as authorized a new share repurchase program worth $50 billion. As of Sept. 30, 2025, almost $41.7 billion in authorization remained available.

This is the second time this year that JPMorgan has hiked its quarterly dividends. In March, it raised its quarterly dividend by 12% to $1.40 per share. In the last five years, it hiked dividends six times, with an annualized growth rate of 8.94%.

Historical Dividend Trend

Similar to JPM, Bank of America and Citigroup cleared the 2025 stress test. Following this, Bank of America raised its quarterly dividend 8% to 28 cents per share and authorized a new $40 billion share repurchase program. Citigroup also announced a dividend hike of 7% to 60 cents per share. It is continuing with the previously announced buyback plan, which had $11.3 billion worth of authorization remaining as of Sept. 30, 2025.

Despite its strengths, JPMorgan remains exposed to several external and sector-specific risks that can weigh on its valuation and earnings trajectory. Interest-rate shifts, economic slowdowns and credit cycle deterioration can adversely impact loan demand, funding costs and credit losses. The company’s provisions for credit losses have remained substantially elevated in recent years because of the challenging operating backdrop. From trending near the mid-$5 billion range during 2018-2019, the metric is now almost double.

Capital markets activity, crucial for trading and IB revenues, is inherently cyclical and sensitive to geopolitical tensions and market volatility. Global deal-making came to a grinding halt at the beginning of 2022, mainly due to the Russia-Ukraine conflict, fears of economic slowdown and high inflation numbers, something JPMorgan wasn’t immune to. As such, the company’s IB fees plunged almost 50% in 2022 and 3% in 2023, before rebounding.

Additionally, competition from fintechs and large non-bank financial players continues to intensify. These uncertainties introduce potential headwinds, making JPMorgan vulnerable despite its scale and operational resilience.

Although a premium valuation compared with the industry and peers makes us apprehensive, JPMorgan remains well-placed for growth backed by its robust capital markets business, dominant IB position, decent NII growth expectations and continued expansion through branch openings and strategic expansion plans.

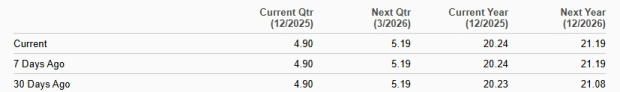

Even analysts are bullish over JPMorgan’s prospects. Over the past month, the Zacks Consensus Estimate for 2025 and 2026 earnings has been revised upward to $20.24 and $21.19, respectively.

Estimate Revision Trend

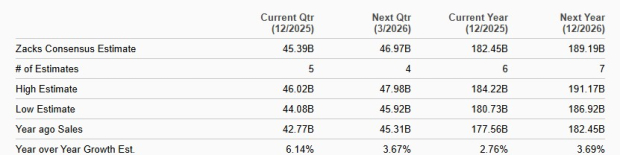

The Zacks Consensus Estimate for JPM’s earnings implies 2.5% and 4.7% year-over-year growth for 2025 and 2026, respectively. Additionally, the consensus mark for 2025 and 2026 revenues suggests a year-over-year rise of 2.8% and 3.7%, respectively.

Sales Estimates

Hence, you should not dismiss JPM just because it trades at a premium. Its size, diversification, track record and recent performance make it a reasonable core holding for a multi-year horizon. However, you must keep an eye on interest-rate moves, macroeconomic headwinds and the banking sector broadly, because these could sway valuations and price movement more than the company’s individual performance.

If you own this Zacks Rank #3 (Hold) stock, retain it, while others may wait for a better entry point. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 4 hours | |

| 11 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite