|

|

|

|

|||||

|

|

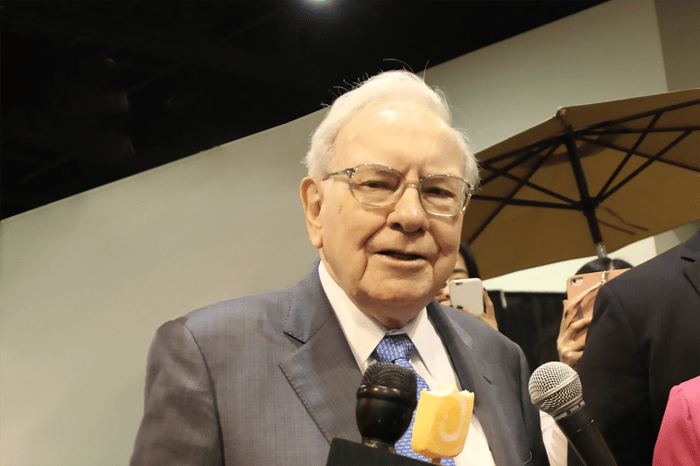

Warren Buffett stepped down as CEO of Berkshire Hathaway at the end of 2025.

But his investing legacy continues through Berkshire's various holdings.

Buffett likes stocks with strong competitive moats and global brand names.

In just a couple of weeks, we'll see the final moves that Berkshire Hathaway made to its venerable portfolio under the direct guidance of Warren Buffett, the legendary investor who stepped down as CEO at the end of 2025, after a 60-year run.

Changes to Berkshire's investment portfolio from the fourth quarter will be disclosed on the company's regular Securities and Exchange Commission Form 13F, which is due 45 days after the end of the quarter. It will be interesting to see what moves, if any, that Buffett approved in his final days before handing control off to his top lieutenant, Greg Abel.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Buffett's time as Berkshire Hathaway's CEO has come to an end, but I expect his vaunted investing principles to remain a signature of the conglomerate he led for decades. Berkshire's investment portfolio includes dozens of companies and is valued at more than $300 billion.

Buffett was a champion of buy-and-hold investing, so let's look at five stocks from his playbook. Each of them held a spot in the Berkshire Hathaway portfolio at the end of 2025, and each of them could help you establish a strong foundation in your investments for the long haul.

Image source: The Motley Fool.

Apple (NASDAQ: AAPL) has been a cornerstone of the Berkshire portfolio for years. Buffett has publicly expressed his admiration for Apple's products and services -- smartphones, computers, wearables, tablets, and its App Store and services division -- and its customer loyalty.

Berkshire has been selling a lot of Apple stock lately. At the end of 2023, the conglomerate held 906 million shares, but that was down to 238.2 million at the end of 2025.

Still, I don't see that as a sign of trouble; I see it as a smart decision to diversify after a position had become overweight. Even after selling all those shares, Apple still makes up 19% of Berkshire's total portfolio -- the largest weighting of any stock held by the company.

Buffett loves credit card companies; Berkshire owns stock in both Mastercard and Visa. But those positions are tiny compared to the 151.6 million American Express (NYSE: AXP) shares in its portfolio. Under the former CEO, Berkshire gained 22% ownership in American Express.

American Express fits the Buffett mold because its customers are loyal -- its gold and platinum business and personal cards are highly prized, and the latter's huge annual fee of $895 helps generate plenty of income.

Amex is also heavily marketing its cards toward a younger audience, with great success: The company said 64% of its new accounts in the third quarter came from millennial and Gen Z customers.

Coca-Cola (NYSE: KO) has been a Buffett favorite for a long time. Not only was he an early investor, having taken a position in the late 1980s, but he's also a fan of its flagship drink. Even when he was in his 90s, Buffett acknowledged drinking five cans of the soda every day.

Berkshire Hathaway still owns 400 million shares of Coke's stock, giving it a stake of more than 9%. That means it will continue to profit from Coca-Cola's extensive product line, which also includes juices, water, sports drinks, teas, and alcoholic beverages.

When Berkshire sold off Apple stock, one of the beneficiaries of that trade was UnitedHealth Group (NYSE: UNH). Buffett took a $1.57 billion position in the healthcare insurer in the second quarter of 2025, buying in as the company was reeling from a poor first-quarter earnings report that marked its first miss of analysts' expectations since the 2008-09 financial crisis.

The company had failed to correctly estimate healthcare costs -- it took a $6.5 billion hit to its Medicare portfolio and its commercial segment, which offers employer plans and coverage under the Affordable Care Act.

But management is fixing the problem, adjusting its Medicare Advantage pricing for 2026 and 2027 to restore attractive profit margins. Even though UnitedHealth Group's stock is down 32% over the last year, it's poised to bounce back in a big way.

You may not know what VeriSign (NASDAQ: VRSN) is, but you probably experience what it does every day: providing domain-name registry services and internet infrastructure. The company is the exclusive registrar for .com and .net domains.

This means that every day, it handles more than 450 billion queries for its domain name system (DNS) -- essentially, the process of a computer calling up a webpage. That kind of competitive moat is something right out of the Buffett playbook, and it's no wonder Berkshire Hathaway owns nearly 9 million shares of the company. In all, the conglomerate has a 9.7% stake in VeriSign.

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $464,439!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,455!*

Now, it’s worth noting Stock Advisor’s total average return is 949% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 26, 2026.

American Express is an advertising partner of Motley Fool Money. Patrick Sanders has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Mastercard, VeriSign, and Visa. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite