|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Veteran investors know that the market's recent weakness is more of an opportunity than an omen. Sure, stocks may not have hit their ultimate bottom just yet. They're arguably closer to it than not, though. And five years from now, you won't care if you stepped in at the exact low. You'll just be glad you jumped in at a great price.

With that as the backdrop, here's a closer look at three stocks that have been dramatically beaten down for all the wrong reasons. Although each one has its own unique risk-reward profile, all three could be a welcome addition to almost anyone's portfolio at their present prices.

In no particular order...

Image source: Getty Images.

While Amazon's (NASDAQ: AMZN) recently reported first-quarter results came in better than expected, guidance for the quarter now underway was a bit of a letdown. The e-commerce powerhouse is looking for a second-quarter top line between $159 billion and $164 billion, up between 7% and 11% from year-ago levels and versus a consensus estimate of $161.2 billion.

And, its expected operating income of between $13 billion and $17.5 billion for the second quarter of this year doesn't compare all that favorably to analysts' average expectation of $17.6 billion, or to the year-earlier figure of $14.7 billion. Last quarter's revenue from the all-important Amazon Web Services (AWS) didn't exactly thrill, either. Shares slipped on the news.

Just don't lose the bigger-picture perspective here.

Sure, guidance was disappointing. All of it still calls for growth, though, and by more than a little, extending long-established trends. It's also arguable that -- as it has in the past -- the company is just making a point of keeping expectations in check.

Then there's the bigger-picture, philosophical bullish argument. That's the fact that Amazon dominates North America's online-shopping landscape by virtue of ingraining itself into customers' lifestyles (with Prime, next-day shipping, automated recurring purchases, and the like).

Consumer researcher Digital Commerce reports Amazon alone accounts for nearly 40% of North America's e-commerce sales, leaving Walmart at a distant second with less than 11% market share. Amazon is unlikely to be dethroned by any rival anytime soon. In fact, it's an outright bully on this front -- an increasingly profitable one that can afford to keep its competitors at bay.

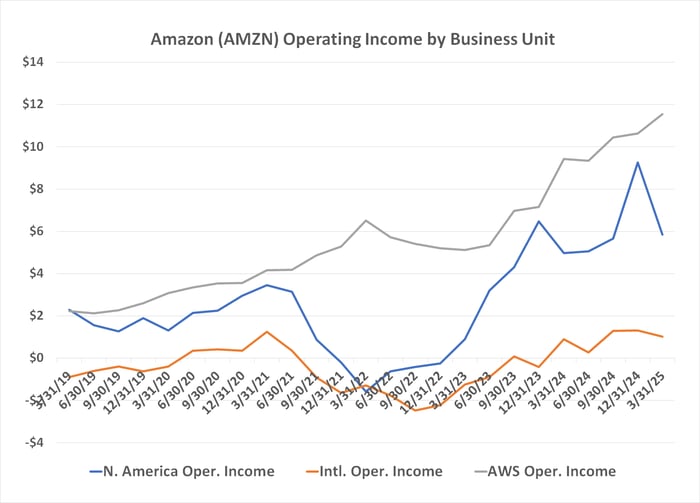

Data source: Amazon Inc. Chart by author. Numbers are in billions of dollars.

The company is not quite as well shielded on the cloud computing front, slowly losing share to Microsoft and Alphabet. Amazon Web Services is still the revenue leader for the worldwide cloud industry, though, and the business is growing faster than Amazon is losing share. Goldman Sachs expects the global cloud services market to grow at an annualized pace of 22% through 2030, for perspective, which will grow Amazon's most profitable business with it.

Bottom line: Down more than 20% prior to Thursday's release of its first-quarter results and second-quarter guidance, Amazon shares already reflected the worst of those numbers without reflecting enough of its long-term potential. The post-earnings lull only makes for a better long-term entry point for shares of a company that enjoys an almost unfair advantage over any and all rivals.

With a market cap of just a little more than $1 billion, Iovance Biotherapeutics (NASDAQ: IOVA) doesn't garner much investor attention. Don't be fooled by its small size and lack of star power, though. Good things come in small packages.

Just as the name suggests, Iovance Biotherapeutics is a biotech. It's a proverbial one-trick pony, in fact. Although it also sells a drug called Proleukin that's largely meant to improve the performance of the company's tumor-fighting flagship drug Amtagvi, first approved early last year.

The idea of investing in a company with a single product (not to mention a narrowly focused one) isn't necessarily a comfortable one; just as it's important to investors' portfolios, diversification is important to individual companies. This is true within the pharmaceutical realm as well, where competitors are forever developing new and better drugs.

If there was ever a good reason to make a bet on a single limited-use product, though, Amtagvi is arguably it. It isn't just the world's first tumor infiltrating lymphocyte (TIL) treatment for certain types of skin cancer. It's one of the few total TIL treatments approved for any reason.

This relatively new path to patient-specific cancer treatments holds enormous promise, though. Credence Research expects the TIL market to grow at an average annual pace of nearly 40% between now and 2032, in fact, while investment research outfit GlobalData believes worldwide annual sales of Amtagvi alone could swell from last year's $103.6 million to $1 billion by 2030.

The key is finding other additional uses for it. That's why Iovance Biotherapeutics is putting Amtagvi to the test in a dozen other clinical trials.

So why is the stock down more than 90% from its early 2021 peak and still knocking on the door of new multiyear lows? That's actually not unusual within the biopharma realm. The market grew too excited when Amtagvi's approval seemingly became inevitable back in 2020, setting the stage for profit-taking that's yet to end. (Hence, "Buy the rumor, sell the news.")

This selling seems to have finally run its full course, however, and may be about to yield to the underlying company's actual fundamentals. These include expected top-line growth of 176% this year and 66% next year, with enough profit progress along the way to push the company out of the red and into the black by 2027.

Lastly, add PepsiCo (NASDAQ: PEP) to your list of stocks to consider buying right now.

It's been a somewhat strange dynamic. Despite the two companies' obvious commonalities, shares of rival beverage giant Coca-Cola (NYSE: KO) continue marching into record-high territory while PepsiCo stock is still testing new multiyear lows.

Some of PepsiCo's recent weakness might stem from its dialed-back earnings guidance for 2025 -- largely due to tariff concerns. The stock's pullback started well before these tariffs were even on the table, though.

What gives? Blame investors' views of how these two companies are different, mostly.

Although PepsiCo is certainly no slouch, Coca-Cola is undeniably the more familiar and more marketable brand, with more leverage to promote its other beverage brands like Gold Peak tea, Minute Maid juices, and Powerade sports drinks. The market may also feel Coca-Cola's heavy use of third-party bottlers is an advantage in the current inflation-riddled environment, as opposed to PepsiCo's preference for in-house and owned production facilities. And to be fair, these aren't crazy assumptions.

It's not as if the two different operating structures don't both come with their own unique upsides and downsides, though. For instance, Coca-Cola may not be prepared for any cost-based pushback that its third-party bottling partners may soon be making, if they're not already.

Conversely, although running your own production facilities can chip away at overall profit margins, PepsiCo enjoys absolute control of its production. If the tariff-crimped environment remains in place for a while, PepsiCo's apparent liability could actually evolve into a competitive edge.

The matter is not perfectly black and white; both business models have their gray areas.

The market is arguably over-rewarding Coca-Cola's approach, however, and underestimating PepsiCo's plausible future. This weakness has also pumped PepsiCo stock's forward-looking dividend yield up to solid 4%, by the way. You would be hard-pressed to find a better yield among blue chip stocks with a similar risk/reward profile.

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 906%* — a market-crushing outperformance compared to 164% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

*Stock Advisor returns as of May 5, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has positions in Alphabet and Coca-Cola. The Motley Fool has positions in and recommends Alphabet, Amazon, Goldman Sachs Group, Iovance Biotherapeutics, Microsoft, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

| 18 min | |

| 19 min |

Stock Market Today: Nasdaq Charges Higher As Trump Announces Global Tariff; Nvidia Rises (Live Coverage)

AMZN

Investor's Business Daily

|

| 1 hour | |

| 2 hours |

Amazon Stock Climbs After Trump Tariff Ruling. E-Commerce Stocks Jump.

AMZN

Investor's Business Daily

|

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Stock Market Today: Dow Turns Higher As Supreme Court Nixes Trump Tariffs (Live Coverage)

AMZN

Investor's Business Daily

|

| 3 hours | |

| 3 hours |

Amazon Stock Climbs After Trump Tariff Ruling. These E-Commerce Stocks Are Up Too.

AMZN

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite