|

|

|

|

|||||

|

|

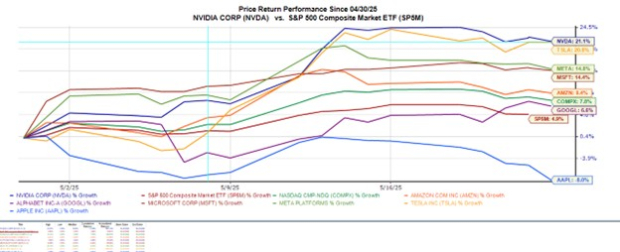

With Q1 results from Nvidia NVDA less than a week away, the chip giant’s stock has rebounded over +20% this month. The rebound has outperformed the broader indexes and led the Mag 7, with most of Nvidia’s big tech peers utilizing the company’s custom chips for their AI endeavors.

Investing heavily in AI, the combined spending of Amazon AMZN, Alphabet GOOGL, Microsoft MSFT, and Meta Platforms META is slated to be over $300 billion in 2025, with total corporate investment on AI expected to be over $500 billion in the U.S. alone.

That said, let’s see if the rally in NVDA can continue with Nvidia set to release its Q1 report on Wednesday, May 28.

Enhancing productivity and efficiency, the AI boom has made it a very relevant time to consider big tech stocks as their ultra-growth prospects have a steroid-like catalyst. On the other hand, there are concerns that increased spending on AI could weigh down shareholder returns, especially if the wave fizzles out or an economic downturn occurs.

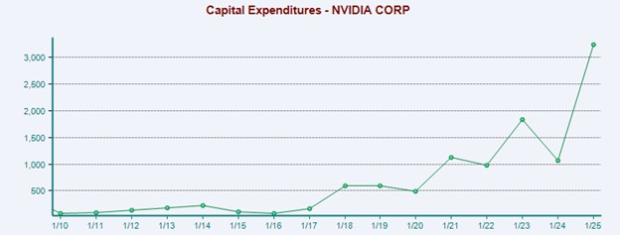

Nvidia CEO Jensen Huang predicts the company’s AI-related investments will grow by over 300% in the next three years as it focuses on ramping up its Blackwell GPU production, the most sought-after and highest-performing AI chips on the market. Coinciding with this, Nvidia’s capital expenditures have spiked over 200% this year to more than $3 billion.

Nvidia also has a significant stake in cloud computing and AI infrastructure provider CoreWeave CRWV, owning 24.18 million CRWV shares in its latest 13F filing. At the same time, Nvidia has recently announced multi-billion-dollar agreements outside of the U.S. and China, as the chip supplier to Saudi Arabia’s new AI venture, Humain.

Based on Zacks' estimates, Nvidia’s Q1 sales are thought to have increased 64% to $42.64 billion compared to $26.04 billion a year ago. On the bottom line, Q1 EPS is expected to rise 39% to $0.85 versus $0.61 a share in the prior period. Sequentially, Nvidia’s Q1 sales would mark 8% growth but a 4% decline from earnings of $0.89 a share in Q4.

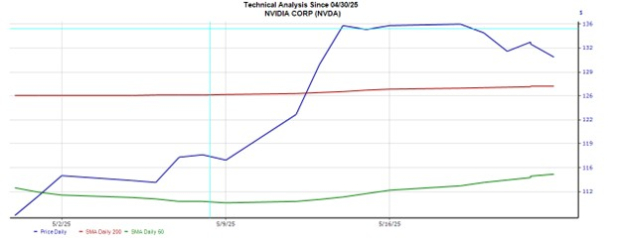

Regarding Nvidia’s latest rally, NVDA continued a bullish ascension after retaking its previous 50-day simple moving average (SMA) of $111 a share in early May and then surged past its former 200-day SMA of $125.

Technical traders will be looking for NVDA to remain above its 200-day SMA, which is currently at $126 a share (Red Line). However, a post-earnings selloff that extends below the current 50-day SMA (Green Line) of $114 would signal a bearish downturn with NVDA soaring from a recent 52-week low of $86 a share in early April.

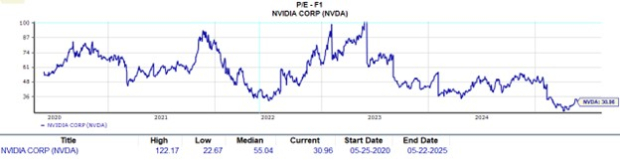

At current levels, Nvidia stock trades at 30.9X forward earnings, which is not an overly stretched premium to the benchmark S&P 500’s 22.5X. Notably, NVDA is at the middle of the Mag 7 in terms of P/E valuation, offering a discount to Amazon, Microsoft, and Tesla TSLA but being above Alphabet GOOGL, Apple AAPL, and Meta.

Seeing as Nvidia stock has been in a league of its own in terms of market gains of over +1,300% in the last five years, it’s noteworthy that NVDA trades well below its high of 122.1X forward earnings during this period and is nicely beneath its median of 55X.

Ahead of its Q1 report next week, Nvidia stock lands a Zacks Rank #3 (Hold). After such a sharp rally over the last month, there could be better buying opportunities ahead as investors will be closely assessing Nvidia’s CapEx spend and guidance, with the chip giant’s mind-boggling sequential growth starting to fade.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite