|

|

|

|

|||||

|

|

As Costco Wholesale Corporation COST prepares to unveil its third-quarter fiscal 2025 earnings results on May 29, after the market closes, investors face an important decision: Should they buy the stock now or hold their current positions? With earnings expectations and market conditions in mind, it is crucial to evaluate key factors influencing Costco’s performance and whether the stock offers an attractive entry point ahead of its earnings report.

Costco's strategic investments, customer-centric approach, merchandise initiatives and focus on membership growth have enabled it to navigate the market. These strengths have resulted in decent sales and earnings growth, positioning COST as a resilient consumer defensive stock.

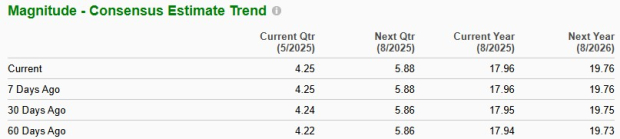

Analysts are optimistic about Costco's upcoming earnings. The Zacks Consensus Estimate for third-quarter revenues stands at $63.1 billion, which indicates an increase of 7.9% from the prior-year reported figure. On the earnings front, the consensus estimate has improved by a penny to $4.25 per share over the past 30 days, implying a 12.4% year-over-year jump.

Costco has a trailing four-quarter earnings surprise of 0.8%, on average. In the last reported quarter, this Issaquah, WA-based company missed the Zacks Consensus Estimate by a margin of 1.7%. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Costco Wholesale Corporation price-eps-surprise | Costco Wholesale Corporation Quote

As investors prepare for Costco's third-quarter announcement, the question looms regarding earnings beat or miss. Our proven model does not conclusively predict an earnings beat for Costco this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. However, that’s not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Costco has a Zacks Rank #2 but an Earnings ESP of -0.61%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Costco’s growth strategies, competitive pricing and membership-driven business model have been instrumental in its sustained success. By offering products at discounted rates, the company appeals to shoppers seeking value and convenience. These factors are expected to have a favorable impact on the overall results.

The company's bulk purchasing power and efficient inventory management allow it to keep prices low. This competitive pricing strategy helps Costco maintain steady store traffic and robust sales volumes. We foresee comparable sales growth of 4.7% during the third quarter, which indicates an expected increase of 5%, 4.1% and 4.2% in the United States, Canada and Other International locations, respectively.

Furthermore, high membership renewal rates, often surpassing 90%, reflect Costco’s strong customer loyalty and provide a dependable revenue source. Membership fees contribute a steady income stream, regardless of broader economic fluctuations. We expect membership fees to increase 9.6% during the quarter under review.

Costco continuously evolves to meet shifting market demands, regularly updating its product portfolio to include everyday necessities and unique, high-demand items. This adaptability has fueled Costco's domestic and international expansion, marked by the steady opening of new warehouse locations and the growth of e-commerce platforms in markets such as the United States, Canada, the U.K., Mexico, Korea, Taiwan, Japan and Australia. We expect e-commerce comparable sales to jump 21% during the quarter under discussion.

With a clear emphasis on delivering value-oriented offerings, Costco remains well-positioned for continued success in the dynamic retail landscape. However, it is essential to acknowledge the presence of certain headwinds, including underlying inflationary pressures, which may pose challenges. Moreover, margins remain a critical area to monitor, with potential concerns stemming from any deleverage in the SG&A rate. We expect SG&A expenses to increase 6.4% year over year.

Costco has witnessed an impressive surge in its stock price over the past year. The stock has rallied 24%, outpacing the industry’s rise of 12.5%.

COST has outperformed its competitors, including Ross Stores, Inc. ROST, Dollar General Corporation DG and Target Corporation TGT. Shares of Ross Stores, Dollar General and Target have faced declines of 0.3%, 28.7% and 35.9%, respectively.

From a valuation standpoint, Costco currently trades at a premium relative to its industry peers. The company’s forward 12-month price-to-earnings (P/E) ratio is 52.28, higher than the industry average of 33.09 and the S&P 500’s 21.36. The stock is also trading above its median P/E level of 50.54, observed over the past year. This elevated valuation suggests that investors might be paying a premium relative to the company's anticipated earnings growth.

Costco is trading at a premium to Target (with a forward 12-month P/E ratio of 11.99), Ross Stores (21.1) and Dollar General (17.61).

COST Valuation Vs Industry

Costco has strengthened its position as a retail powerhouse, thanks to its strong membership model, competitive pricing and ability to adapt to evolving market trends. While the stock’s premium valuation might deter some investors, its steady growth, robust financial health and strategic initiatives indicate the potential for further upside. Current investors may consider holding or adding to their positions, while prospective investors could see any dips as a buying opportunity.

Costco is poised to deliver a decent third-quarter fiscal 2025 earnings report, supported by its strategic growth initiatives and loyal customer base. The anticipated growth in revenues and earnings highlights the strength of its membership-driven model and pricing strategy, which continues to attract value-seeking consumers. For investors seeking a stable yet growth-oriented stock, Costco appears to be a compelling choice.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite