|

|

|

|

|||||

|

|

Baxter International Inc. BAX reported second-quarter 2025 adjusted earnings per share (EPS) of 59 cents, which missed the Zacks Consensus Estimate of 60 cents by 1.7%. The bottom line improved 28.3% from the year-ago quarter’s level.

On a GAAP basis, the company reported EPS of 18 cents compared with a cent in the prior-year quarter.

Revenues from continued operations totaled $2.81 billion, up 4.3% on a reported basis and 1% on an operational basis. The figure missed the Zacks Consensus Estimate by 0.4%.

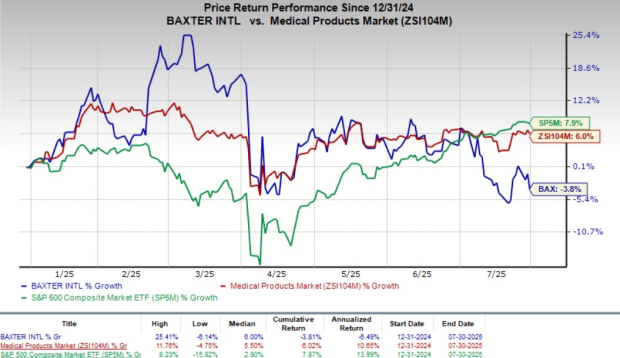

Shares of BAX declined 8.9% in pre-market trading following lower-than-expected quarterly results. The company’s shares have lost 3.8% in the year-to-date period against the industry’s growth of 6%. The broader S&P 500 Index has increased 7.9% in the same period.

Medical Products & Therapies

The segment includes Advanced Surgery and a new category — Infusion Therapies & Technologies. Sales in this segment totaled $1.32 billion, flat year over year reportedly and up 1% on an operational basis. Growth in the quarter reflected strength in the Advanced Surgery and infusion systems products, partially offset by softness in demand for IV solutions.

Infusion Therapies and Technologies’ sales totaled $1.02 billion, down 2% year over year reportedly and 1% on an operational basis. Advanced Surgery category sales amounted to $296 million, up 7% year over year reportedly and up 5% on an operational basis.

Healthcare Systems and Technologies

The segment includes the Front Line Care category. It also consists of the Patient Support Systems and Surgical Solutions categories, which are clubbed as Care & Connectivity Solutions. Total sales in this segment were $767 million, up 3% year over year reportedly and 2% on an operational basis. The performance reflected solid global growth for the Care & Connectivity Solutions division, partially offset by softness in select markets outside the United States.

Front Line Care category sales totaled $293 million, down 1% year over year reportedly as well as on an operational basis. Care & Connectivity Solutions category sales amounted to $474 million, up 5% year over year reportedly and 4% on an operational basis.

Pharmaceuticals

The segment presently includes two product categories — Injectables & Anesthesia and Drug Compounding. Total sales during the second quarter were $612 million, up 2% year over year reportedly and 1% on an operational basis. The strong quarterly performance was primarily due to strength in Drug Compounding, partially offset by reduced sales of Injectables & Anesthesia.

Injectables and Anesthesia category sales totaled $332 million, down 3% year over year reportedly and down 4% on an operational basis. The Drug Compounding category sales amounted to $280 million, up 7% year over year reportedly as well as on an operational basis.

Other

Revenues in the segment amounted to $111 million, up 405% on a year-over-year basis.

Baxter reported an adjusted gross profit of $1.14 billion, almost flat year over year. As a percentage of revenues, the adjusted gross margin contracted 170 basis points (bps) to 40.7%.

Selling, general and administrative expenses amounted to $718 million, down 0.7% from the year-ago quarter’s figure. Research and development expenses totaled $134 million, up 3.1% on a year-over-year basis.

Adjusted operating income from continuing operations totaled $423 million, up 18.5% year over year. As a percentage of revenues, the adjusted operating margin improved 180 bps to 15.1%.

Baxter issued and updated its guidance for third-quarter and full-year 2025, respectively.

For the third quarter, Baxter anticipates sales from continuing operations to grow 6-7% reportedly and 3-4% on an operational basis. The adjusted EPS for the period is expected to be in the range of 58-62 cents. The Zacks Consensus Estimate for sales and EPS is pegged at $2.90 billion and 64 cents, respectively.

For full-year 2025, continuing operational sales growth is now expected to be 6-7% reportedly and 3-4% on an operational basis. The Zacks Consensus Estimate for the metric is pegged at $11.35 billion, implying a year-over-year decline of 11.7% reportedly. Adjusted EPS is now projected to be in the band of $2.42-$2.52 compared with the previous guidance of $2.47- $2.55. The Zacks Consensus Estimate is pegged at $2.50.

Baxter International Inc. price-consensus-eps-surprise-chart | Baxter International Inc. Quote

Baxter exited the second quarter on a weak note, with both earnings and sales missing estimates. The expansion of adjusted operating margin bodes well for the stock, although adjusted gross margin witnessed a decline.

Meanwhile, Baxter announced that inventory levels have been restored and allocations removed for all IV solutions product codes manufactured at the site following the impact of Hurricane Helene. This is likely to boost the demand for IV solutions going forward. The company expanded the Vizient Reserve program to include IV fluids during the second quarter to help ensure reliable access during times of supply disruption.

Baxter launched Hemopatch Sealing Hemostat with room temperature storage in several European markets. This product advancement is particularly impactful in surgical settings, where speed and accessibility are critical. Previously requiring cold storage, the updated Hemopatch can now be stored at room temperature, allowing for easier handling and quicker access during procedures. This improvement supports surgeons with a readily available tool for managing bleeding and leakage, enhancing surgical efficiency and potentially reducing complications during critical moments in the operating room.

Currently, Baxter carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space that are expected to report earnings soon are Align Technology ALGN, Cardinal Health, Inc. CAH and Cencora, Inc. COR.

The Zacks Consensus Estimate for Align Technology’s second-quarter 2025 adjusted EPS is currently pegged at $2.57. The consensus estimate for revenues is pegged at $1.06 billion. ALGN currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has an estimated long-term growth rate of 11.2%. However, ALGN’s earnings yield is 5.1% compared with the industry’s 5.4%.

Cardinal Health currently has a Zacks Rank #2. The Zacks Consensus Estimate for fourth-quarter fiscal 2025 adjusted EPS is currently pegged at $2.03 and the same for revenues is pinned at $60.67 billion.

Cardinal Health has an estimated long-term growth rate of 10.9%. CAH’s earnings yield of 5.7% compares favorably with the industry’s 5.5%.

Cencora currently carries a Zacks Rank #2. The Zacks Consensus Estimate for third-quarter fiscal 2025 adjusted EPS is currently pegged at $3.78 and the same for revenues is pinned at $80.33 billion.

Cencora has an estimated long-term growth rate of 12.8%. COR’s earnings yield of 5.4% compares favorably with the industry’s 4.1%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite