|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Ross Stores, Inc. ROST is expected to register top-line growth when it reports second-quarter fiscal 2025 results on Aug. 21, after market close. The Zacks Consensus Estimate for earnings is pegged at $1.52 per share, implying a 4.4% drop from $1.59 reported in the year-earlier period. The consensus mark has moved down 1.3% in the past 30 days.

The consensus estimate for quarterly revenues is pegged at $5.53 billion, indicating growth of 4.7% from the year-ago quarter’s reported figure.

ROST has a trailing four-quarter earnings surprise of 6.1%, on average. In the last reported quarter, the company posted an earnings surprise of 2.8%.

Our proven model conclusively predicts an earnings beat for Ross Stores this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Ross Stores currently has an Earnings ESP of +0.49% and a Zacks Rank of 3.

Ross Stores’ second-quarter fiscal 2025 performance is expected to have been bolstered by strong growth across its merchandise categories, driven by positive customer responses across both banners. The company’s ability to offer value-driven bargains continues to resonate with price-conscious consumers, particularly in an environment where discretionary spending remains cautious.

ROST is expected to have benefited from its off-price retail model to attract value-focused shoppers. Additionally, its micro-merchandising strategy optimizes product allocation, ensuring inventory aligns with regional consumer preferences and supports margins. The company’s proven business model is likely to have driven higher traffic, boosted same-store sales growth and improved profitability.

On the last reported quarter’s earnings call, Ross Stores stated that comps trends have been favorable through May and have continued into June. As a result, the company predicts sequential comparable sales (comps) between flat and up 3% for second-quarter fiscal 2025. The improvement in comps is driven by favorable trends across most merchandising categories, with strong performance across most departments in April. This reflects the company’s continued confidence in its business amid the ongoing macroeconomic and geopolitical uncertainties.

Consistent execution of store expansion plans is also expected to have supported top-line growth. These efforts have focused on expanding penetration in existing and new markets, with contributions from new stores anticipated to be reflected in the to-be-reported quarter’s results.

Ross Stores, Inc. price-eps-surprise | Ross Stores, Inc. Quote

However, Ross Stores has been cautious regarding the ongoing macroeconomic and geopolitical uncertainties and persistent inflation, which have been impacting consumer spending on essentials like housing, food and gasoline.

Ross Stores is grappling with renewed tariff headwinds as evolving trade policies, prolonged inflation and elevated duties on China-sourced goods add pressure to its cost structure. Although the company directly imports only a small portion of its merchandise, more than half of the products it sells originate from China, making it vulnerable to escalating tariff-related costs.

As a result, Ross Stores is approaching the near-term with caution amid ongoing macroeconomic and geopolitical uncertainties, anticipating impacts on profitability and margins if current tariff levels persist. The company noted that numerous unknown variables continue to limit visibility into the second half of fiscal 2025. Due to the unpredictable nature of tariff developments and lack of visibility, the company has withdrawn its fiscal 2025 sales and earnings guidance and offered a more limited outlook for the fiscal second quarter.

As Ross Stores is already bracing for short-term margin compression, it forecast fiscal second-quarter EPS of $1.40-$1.55, whereas it reported $1.59 in the prior-year period. This decline is mainly due to the impacts of 11-16 cents per share from announced tariffs. While mitigation strategies like sourcing shifts and vendor negotiations are underway, these measures may not fully neutralize the financial strain, especially amid broad-based inflation and limited pricing flexibility.

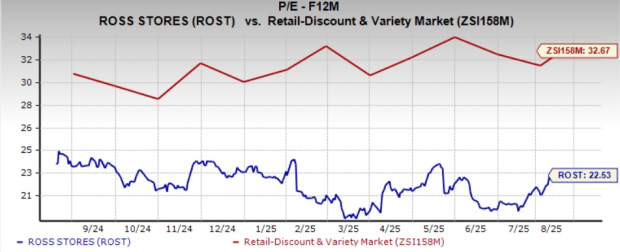

From a valuation perspective, Ross Stores is trading at a discount relative to industry benchmarks. The company has a forward 12-month price-to-earnings of 22.53X, lower than the Retail-Discount Stores industry’s average of 32.67.

The recent market movements show that ROST’s shares have lost 4.7% in the past three months compared with the industry's 2.7% decline.

Here are some other companies, which, according to our model, also have the right combination of elements to beat on earnings this reporting cycle.

Walmart Inc. WMT has an Earnings ESP of +1.26% and a Zacks Rank of 2 at present. WMT is likely to register top and bottom-line growth when it releases second-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $175.5 billion, which implies growth of 3.7% from the figure reported in the year-ago quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for Walmart’s quarterly earnings has increased a penny in the past seven days to 73 cents per share, implying growth of 9% from the year-ago quarter’s reported number. WMT delivered an earnings surprise of 5.3%, on average, in the trailing four quarters.

Five Below, Inc. FIVE currently has an Earnings ESP of +13.35% and a Zacks Rank of 3. FIVE is likely to register top and bottom-line increases when it reports second-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $997.3 million, indicating a 20.2% rise from the figure reported in the prior-year quarter.

The consensus estimate for Five Below’s earnings is pegged at 61 cents per share, implying a 13% jump from the year-ago quarter’s actual. FIVE’s earnings estimates have increased a penny in the past seven days. FIVE delivered an earnings surprise of 42.3% in the last quarter.

The Home Depot Inc. HD has an Earnings ESP of +0.35% and a Zacks Rank of 3 at present. HD is likely to register top and bottom-line growth when it releases second-quarter fiscal 2025 results. The Zacks Consensus Estimate for its quarterly revenues is pegged at $45.5 billion, which implies growth of 5.4% from the figure reported in the year-ago quarter.

The consensus estimate for Home Depot’s quarterly earnings has been unchanged in the past 30 days at $4.71 per share, implying growth of 0.9% from the year-ago quarter’s number. HD delivered an earnings surprise of 2.2%, on average, in the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite