|

|

|

|

|||||

|

|

If you are from the West and can venture to a country like Cuba, you will witness crumbling infrastructure, 1950s-era cars, and extreme poverty. Centralized economies, such as Cuba or China, where the government controls the economy and can shut down private enterprises on a whim, suffocate innovation and choke the entrepreneurial spirit. Conversely, America’s capitalistic system is not perfect. Much of the population is addicted to their Apple (AAPL) smartphones, and critics argue that despite the United States’ wealth, there is less of a safety net in areas like healthcare when compared to Nordic countries, for example.

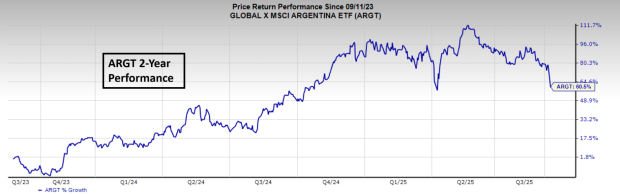

Nevertheless, history proves that capitalism is the most perfect system in an imperfect world. You don’t need to go too far back in history to find evidence. For instance, after decades of socialism, Argentina did a 180-degree turn and elected a free-market president named Javier Milei. When Milei was elected in November 2023, Argentina’s monthly inflation rate was an astonishing 25%. Since then, Argentina’s monthly inflation rate has plummeted to 1.9%. Meanwhile, the US-based MSCI Argentina ETF (ARGT) has nearly doubled.

Though America’s “golden goose of capitalism” leads to cutthroat competition for entrepreneurs, it is also is responsible for driving the powerful engine of economic growth and wealth that is the US economy.

The job of the savvy investor is to search for America’s best and brightest innovators and disruptors. 25 years ago, Blockbuster Video, the dominant video brick-and-mortar movie rental retailer of the time, rested on its laurels. At the time, Netflix (NFLX) was an obscure mail-based rental business. Blockbuster offered the upstart company $50 million, but never came to an agreement. The rest is history – Netflix would eventually pivot to a streaming business and send Blockbuster out of business. Each year, there are countless examples of disruptors trying to emulate Netflix’s unlikely rise to prominence. For example, OpenAI and Microsoft’s (MSFT) ChatGPT chatbot is completely disrupting search, which Alphabet (GOOGL) has a monopolistic stranglehold on. Unlike Blockbuster, Google co-founder Sergey Brin is taking new innovation seriously and sees such a threat that he unretired recently to work on Google’s Gemini AI model.

Today, I will dissect three companies disrupting their industries.

Years ago, the late Steve Jobs brought Apple from obscurity to legend with his innovations. Job’s genius was to take a dull industry and make it fun, innovate at a rapid pace, combine multiple products into one seamless product, and then present it in a way that people can understand. Robinhood (HOOD) CEO Vlad Tenev is taking a page out of the Steve Jobs playbook. Despite the highly regulated and typically slow-moving financial services industry, Tenev has parlayed the company that started with humble beginnings as the first commission-free broker into a financial powerhouse through blistering innovation and product release.

During Tuesday night’s “HOOD Summit 2025,” Tenev and his team released several new and unique products, including:

· Robinhood Social: A platform that allows Robinhood users to track strategies, shadow trade, and create profiles.

· AI Research Tools: Robinhood is the first major broker to embrace AI, enabling customers to create custom indicators simply by speaking to their Robinhood platform.

· Overnight Index Options: Unlike most competitors, Robinhood users can trade equities overnight. Last night, the Robinhood team took it a step further and announced overnight index options.

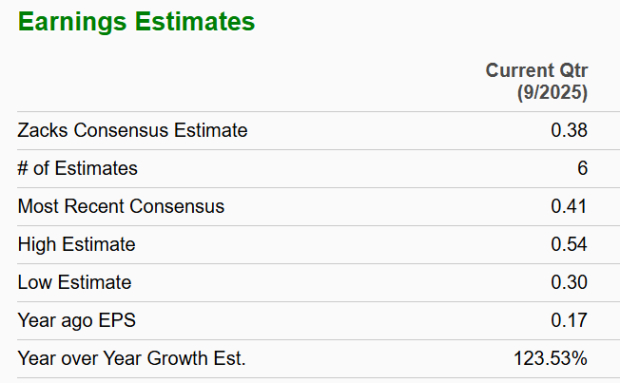

Thus far, Tenev’s innovative spirit is paying dividends. HOOD has beaten Zacks Consensus Estimates by a juicy 19.46% over the past four quarters.

The momentum doesn’t stop there. HOOD earns a best possible Zacks Rank #1 (Strong Buy) and was recently added to the S&P 500 Index.

Unlike Robinhood, OpenDoor Technologies (OPEN) is a speculative company, but an innovative one, nonetheless. The company is following a similar trajectory to Carvana (CVNA), an e-commerce automotive retail leader. A few years ago, Carvana was a beaten-down, debt-riddled company. However, Carvana management secured funding, found its niche in the automotive space, and leveraged momentum from a massive retail investor following. OPEN is a pioneer in the instant buying real estate sector. Instead of going through the tedious process of finding a realtor, dealing with showings, open houses, and uncertainty, homeowners can use OPEN. Like Carvana does with cars, OPEN clients can request a quote for their home on OpenDoor and receive a cash offer within two days.

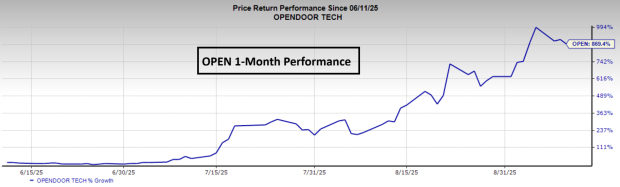

If OpenDoor can successfully replicate the CVNA playbook in the real estate sector, it can disrupt a massive market. Like CVNA, OPEN has won over the retail crowd, and momentum is building with shares up a scorching ~900% over the past month.

Meanwhile, shares jumped more than 20% Wednesday night after former Shopify (SHOP) COO Kaz Nejatian was named new CEO. Additionally, OPEN founders Keith Rabois and Eric Wu announced that they will rejoin the board of directors.

Bottom Line

Capitalism, for all its imperfections, has proven to be an engine of innovation, prosperity, and disruption. As investors, our role is to identify these disruptors. Companies like Robinhood and OpenDoor challenge the status quo.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 38 min | |

| 44 min | |

| 55 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite