|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

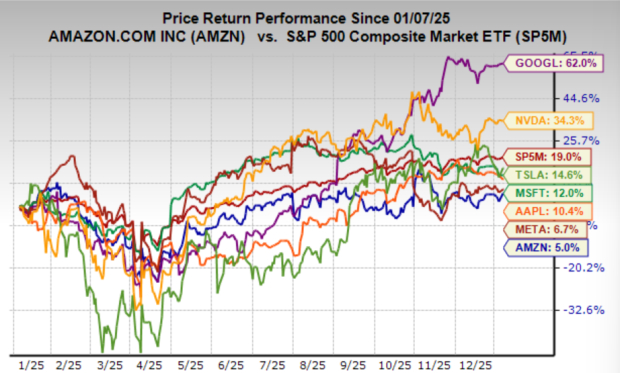

Last year was another strong one for the world’s leading technology companies, the so-called Magnificent 7. While artificial intelligence has clearly acted as a tailwind, underlying business performance has remained strong even absent AI-driven contributions, with these companies continuing to deliver durable revenue growth and reinforce competitive advantages few peers can match. Importantly, they sit at the center of some of the most powerful and enduring secular trends in the global economy. That backdrop remains intact as we move into 2026, though positioning within the group has begun to diverge.

Somewhat counterintuitively, Meta Platforms (META) and Amazon (AMZN), the two weakest performers within the cohort in 2025, now appear among the best positioned for the year ahead, alongside Alphabet (GOOGL). That does not preclude the rest of the group from participating in further upside, but it does suggest that relative opportunity is shifting. Below, I outline the evolving setups across each of the Magnificent 7 and how to think about trading them in the year ahead.

After lagging the broader group in 2025, Amazon and Meta Platforms appear positioned for a rebound year. Both companies continue to deliver solid revenue and earnings growth, yet limited share appreciation has left valuations at some of the most attractive levels seen in years. Meta currently trades at roughly 21.9x forward earnings, while Amazon trades near 30.7x, both well below their respective historical medians. From an analyst outlook perspective, Meta carries a Zacks Rank #3 (Hold), reflecting stable earnings revisions, while Amazon holds a stronger Zacks Rank #2 (Buy).

Technical conditions also favor both names. Meta shares have been consolidating in a tight range over recent weeks, a pattern that often precedes a breakout. Amazon displays a similar setup, but has already begun to resolve to the upside, breaking out on strong volume yesterday.

Fundamentally, both companies retain compelling bullish catalysts. Amazon continues to pursue multiple AI-driven growth avenues, most notably at the infrastructure level through AWS, where demand for compute and cloud services remains robust. Meta, meanwhile, has been among the most effective adopters of AI within its advertising platform, translating technological advances directly into improved monetization and margins. In addition, Meta’s recent acquisition of Manus AI, while relatively under the radar, could prove strategically meaningful. Among LLM applications currently available, Manus stands out for its sophistication and could reestablish Meta as a serious competitor in consumer-facing AI, an area where it has previously lagged.

Alphabet, by contrast, was the top performer within the group last year, as the market belatedly recognized its strength in AI. Its large language model ranks among the industry’s leaders, and its vertically integrated hardware ecosystem, built around proprietary TPUs, provides a durable and differentiated competitive advantage. Alphabet shares are now emerging from a consolidation phase of their own, suggesting the potential for continued upside.

Taken together, these three names offer a balanced opportunity set: two former underperformers with improving setups and valuation support, alongside a proven leader that continues to execute. In all cases, AI acts as a meaningful accelerant rather than the sole driver of the investment thesis.

Microsoft (MSFT), a clear leader across global technology, has seen its share price stall in recent months, failing to make sustained progress since early summer and slipping modestly lower during the fourth quarter. That consolidation, however, appears to be stabilizing. The stock has repeatedly tested a key support zone and, so far, has been unable to break meaningfully below it, suggesting downside pressure may be exhausting.

Fundamentally, Microsoft’s outlook is also beginning to firm. The company has seen modest upward revisions to earnings expectations, lifting the stock to a Zacks Rank #2 (Buy). As long as shares continue to hold above the roughly $470 support level, the risk-reward profile appears increasingly attractive.

Nvidia (NVDA) currently carries a Zacks Rank #1 (Strong Buy), reflecting unanimous upward revisions to earnings expectations across multiple time horizons. Over the past 60 days alone, analysts have raised next year’s EPS estimates by roughly 16%, a clear signal that fundamentals continue to surprise to the upside.

Valuation still remains compelling relative to growth as well. Nvidia trades at 40.1x forward earnings, while long-term EPS is projected to grow at an annualized rate of about 46% over the next three to five years. On that basis, the world’s largest publicly traded company is trading at a PEG ratio below 1, a rare setup at this scale.

Crucially, Nvidia is not standing still despite its leadership position in the AI boom. The company continues to invest aggressively across the full AI stack, with a growing emphasis on next-generation architectures and inference optimization—an area poised to become an increasingly important profit pool as AI workloads scale. That strategy was reinforced by Nvidia’s recent acquisition/partnership with chip start up Groq, strengthening its capabilities around low-latency inference and performance-optimized chip design ahead of its upcoming Rubin architecture. Together, these developments keep Nvidia at the top of investors’ watchlists.

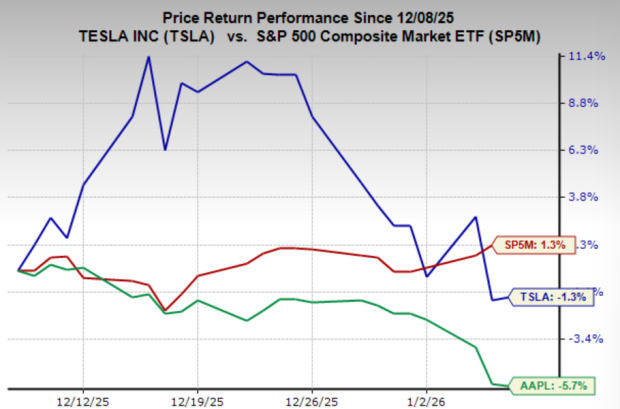

While both Apple (AAPL) and Tesla (TSLA) enjoyed late-year rallies, their price action setups remain a concern heading into 2026. They are currently the only two names within the Magnificent 7 trading in clear, sustained downtrends, an important distinction as leadership within the group shows signs of rotation.

Tesla’s narrative remains characteristically ambitious, with Elon Musk continuing to highlight long-term opportunities ranging from autonomous driving to humanoid robots. However, investor focus has shifted back to near-term fundamentals, where the picture has deteriorated. Top-line growth has stalled since 2023 and market share has declined, as the company was surpassed by BYD as the world’s largest EV producer last year. To date, there is limited evidence of a meaningful reacceleration in vehicle demand.

At the same time, valuation remains a significant headwind. Tesla currently trades at more than 200x forward earnings and roughly 13x forward sales—multiples that exceed even those of most high-growth, high-margin software companies. While Tesla has historically commanded premium valuations, the combination of slowing growth and shifting sentiment meaningfully increases downside risk in the near to intermediate term.

Apple, by contrast, does not carry the same fundamental risk profile, but it appears relatively less compelling versus peers. The company has taken a notably restrained approach to the AI arms race, opting not to match rivals’ aggressive infrastructure spending. While that decision initially weighed on sentiment amid fears Apple could fall behind, it has since proven more defensible. Apple remains the world’s leading platform for mobile compute and consumer devices, positioning it as one of, if not the primary distribution points for AI-enabled applications over time. Still, with fewer near-term catalysts and weaker relative momentum, Apple currently sits behind other Magnificent 7 names from a trading perspective.

As we move into 2026, the Magnificent 7 continue to offer a deep and diverse opportunity set. Differences in earnings momentum, technical structure, and near-term catalysts are creating multiple ways to participate, whether through leaders extending their runs or laggards setting up for rebounds.

For investors, the key is staying aligned with where fundamentals and price action are reinforcing each other. Done right, the Magnificent 7 should remain a core source of opportunity in 2026, not just as a group, but through the distinct paths each company is taking as the next phase of the cycle unfolds.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours |

How Will Dow Jones Futures Open After Trump Hikes Global Tariff To 15%?

GOOGL NVDA

Investor's Business Daily

|

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite