|

|

|

|

|||||

|

|

Amid Wall Street volatility, most “Magnificent 7” stocks have suffered violent drawdowns thus far in 2025. However, Zacks Rank #3 (Hold) stock Netflix (NFLX) has bucked the market weakness ahead of its Q1 earnings release on Thursday. While Netflix is consistently overlooked versus its big tech peers, there are five key reasons investors should not forget about the leading streaming giant, including:

1. Netflix is Mostly Immune from Tariffs

A centerpiece of President Donald Trump’s second term is to decrease reliance on the international market, decrease (and ultimately balance) trade deficits, and make trade fairer for the United States. However, the Trump Administration’ssomewhat confusing and everchangingtariff policy isone of the most signficant question marks for “Magnificent 7” stocks like Amazon (AMZN), Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), and Tesla (TSLA). Each of these companies has significant production and parts sourced from overseas, subjecting them to tariffs.

Netflix, on the other hand, is the only big tech stock that is largely unaffected by the uncertainty surrounding the current trade policy. Digital services like Netflix are currently not a top priority for the Trump Administration because the United States already enjoys a large trade surplus in digital services. In addition, digital goods are not beholden to tariffs under the World Trade Organization (WTO) policy.

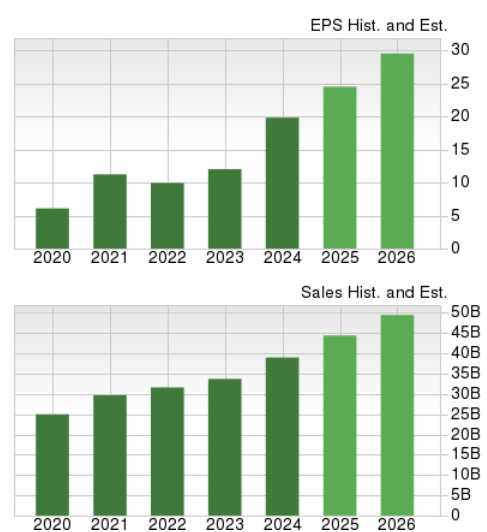

2. Netflix is the Fastest Growing Mag 7 Name

Last quarter, Netflix earnings bolted 102% year-over-year, making it the fastest-growing Mag 7 name. Despite intense competition from Amazon’s Prime, Alphabet’s (GOOGL) YouTube TV & YouTube Premium, and the Disney (DIS) Plus streaming services, Netflix’s management has done a masterful job of growing the company. Here’s how:

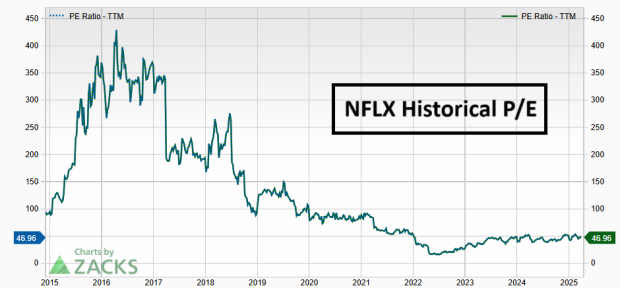

3. Netflix’s Historically Low Valuation

Though NFLX shares have performed well over the past few years, shares are cheap. NFLX’s price-to-earnings ratio of 46.96x means shares are hovering near their “cheapest” levels over the past decade. While a 46 p/e may seem high to investors, context is essential. Because Netflix highest and most consistent growth versus “Mag 7” names, investors are willing to pay a premium.

4. Netflix Exhibits Relative Strength

The best time to look for long-term RS opportunities is within a bear market. New, inexperienced investors tend to get frustrated and give up during bear markets. Conversely, savvy investors understand that bear markets present easily identifiable extremes. Because 75% of stocks follow the general market’s direction, you would expect most stocks to fall amid tariff concerns. However, NFLX shares have recently decoupled from the Mag 7 and the general market. While all Mag 7 names and the Nasdaq 100 Index (QQQ) are stuck below their 200-day moving averages, NFLX has carved out a picture-perfect double-bottom base structure above it – a sign of relative price strength.

5. Bullish Earnings Surprise History

Netflix has a bullish earnings surprise history, beating Zacks Consensus Analyst Estimates for four consecutive quarters.

Though NFLX is positioned well, there are some concerns on the bearish side. First, Wall Street analysts have soured on the company over the past few months, leading to a negative Zacks Earnings Expected Surprise Prediction (ESP) score. Second, the general market environment remains uncertain.

Bottom Line

While most “Magnificent 7” and big tech stocks have experienced significant declines amidst Wall Street’s volatile start to 2025, Netflix stands out as a resilient performer ahead of its upcoming Q1 earnings report on Thursday. This strength is due to several factors, including its insulation from tariffs, leading growth rate, historically low valuation, relative price strength, and consistent earnings surprise track record.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 17 min | |

| 19 min | |

| 19 min |

How hyperscalers like Oracle and Meta are driving the AI arms race

MSFT GOOGL AMZN

Yahoo Finance Video

|

| 19 min | |

| 24 min | |

| 36 min | |

| 48 min | |

| 48 min | |

| 49 min |

Uber, Latest Victim of Disruption Panic, Still Has Role in Robotaxis

TSLA GOOGL

The Wall Street Journal

|

| 50 min | |

| 52 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite