|

|

|

|

|||||

|

|

Stocks surged on Monday as the U.S. and China announced a deal to temporarily reduce their high reciprocal tariffs, leading to much optimism that a global economic recession may be avoided.

Easing an ongoing trade war, the U.S. is cutting tariffs on China to 30% from 145%, with China reducing tariffs on U.S. goods to 10% from 125%. The agreement will last 90 days, as the two sides work on building a sustainable, long-term trade relationship.

The S&P 500 rose +3% in today’s trading session, with the Nasdaq spiking over +4%, as investors flock to big tech stocks that had sold off during rising trade tensions.

At the center of what has been a historic market rebound are the mega-cap big tech stocks, with Apple AAPL, Amazon AMZN, Meta Platforms META, and Tesla TSLA leading the market gains on Monday and up over +6% respectively.

It’s likely that analysts may become more bullish on Apple’s short-term outlook as most of the electronic giant’s production comes from China.

A continued run-up in Apple, Amazon, and Meta stock looks fundamentally plausible, but it’s noteworthy that Tesla lands a Zacks Rank #5 (Strong Sell) based on a trend of declining earnings estimate revisions. Suggesting now may be a good time to fade the rally in Tesla stock is that TSLA has spiked +25% in the last month. Furthermore, Tesla has the highest P/E valuation among the Mag 7 at 161.4X forward earnings, with Alphabet GOOGL being the cheapest at 16.2X.

Nvidia NVDA and Microsoft MSFT have started to gain nice momentum as well, although the latter was only up +2% today. Still, Microsoft is the only Mag 7 stock that currently has a buy rating with a Zacks Rank #2 (Buy) while the others all land a Zacks Rank #3 (Hold) outside of Tesla’s strong sell rating. This comes as fiscal 2025 EPS estimates for Microsoft are up 2% over the last 60 days, with FY26 EPS estimates up 1%.

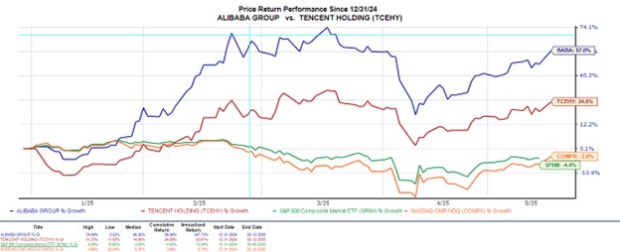

Optimistically, Chinese tech stocks have already benefited from higher investor sentiment before the tariff truce with the U.S., as Chinese President Xi Jinping has been more supportive of their independent growth. With regulatory issues being less of a concern to investors, Alibaba BABA and Tencent TCEHY are two Chinese tech stocks to pay attention to and currently sport a Zacks Rank #2 (Buy).

Their ADR’s (American Depository Receipts) have been two of the top performers on U.S. stock exchanges this year, with BABA soaring nearly +60% year to date and TCEHY up over +20%. The strong price performance has been due to their artificial intelligence expansion, leveraging AI to enhance efficiency, reduce costs, and improve customer experience, as Alibaba has seen higher e-commerce sales, and Tencent has benefited from growth in its gaming and cloud services.

Outside of Amazon and Apple, retailers like Nike NKE, Starbucks SBUX, and even Walmart WMT and Target TGT rely heavily on supply chain operations from China. Nike and Starbucks also generate a significant portion of their revenue from their operations within China, which would make better trade and political relations between the U.S. and China beneficial to their outlook.

Nike and Walmart stock stand out with a Zacks Rank #3 (Hold), while Starbucks and Target have a Zacks Rank #4 (Sell). Plus, China accounted for 14% of Nike’s revenue in 2024, with $5.5 billion coming from footwear sales alone, as shown in the chart below.

Energy and transportation stocks will also be important to watch, as they could receive a continued boost in the following weeks thanks to today’s trade agreement. While geopolitical tensions can often cause an uptick in crude oil prices, the trade war between the U.S. and China had an adverse effect in regard to how the market saw future demand for travel and other activities that require higher energy production. Crude prices were up as much as +2% to over $62 a barrel but are still down 20% in 2025.

The U.S. and China trade agreement gave the market what it was looking for, as investors now have more reassurance that the global economy will be less impacted by higher tariffs. That said, keeping an eye on the progress that is hopefully made in the next 90 days will be critical, considering the U.S. and China are the world's two largest economies.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 35 min |

Trump Says Khamenei Killed In U.S.-Israeli Attacks. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 53 min | |

| 1 hour |

Trump Says Khamenei Likely Killed In U.S.-Israeli Attacks On Iran. How Will Dow Jones Futures React?

AAPL

Investor's Business Daily

|

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite